Common Banking Frauds That You Should Be Aware Of!

Bank fraud is defined as the illegal attempt to acquire access to the funds and assets of a bank or its customers through deception. One of the most critical obligations a bank or financial institution has is to defend the integrity of the institution by putting forth significant effort to safeguard the financial assets that the institution possesses. In order to do so, the bank or financial institution must be satisfied that the issue of bank fraud is being addressed appropriately.

Bank fraud can be defined as unethical and/or criminal conduct committed by an individual or organization in order to illegally get possession of our receipt of funds from a bank or financial institution without the permission of the institution. Essentially, fraud in the banking industry happens when someone seeks to obtain dollars or other assets from a financial institution or from consumers of that financial institution by impersonating a bank official. Bank fraud is often considered a criminal offense in many jurisdictions.

While the specific features of individual banking fraud laws differ depending on the jurisdiction, the phrase “bank fraud” refers to activities that involve the use of a scheme or artifice, as opposed to bank robbery or theft, and is used to describe actions that involve the use of a scheme or artifice. As a result, bank fraud is sometimes referred to as a white-collar crime in the United States.

If this seems to have caught your attention and you want to learn about the different types of banking frauds that take place nowadays as well as how to avoid falling victim to them, then continue reading! You can thank us later.

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

If you’re someone who wants to protect your financial data, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

8 Most Common Types of Banking Frauds

Fraudulent bank transactions are a typical method for fraudsters to get personal and financial information from unsuspecting victims. In 2020, the Federal Trade Commission will have received more than 2.1 million consumer fraud reports, according to the agency.

Various strategies are used by scammers to deceive consumers into disclosing sensitive information such as bank account numbers and passwords. To learn about eight classic bank scams and what you can do to protect yourself, continue reading this article.

1. Overpayment scams

It’s possible that you’ll become a victim of an overpayment scam if you provide services or sell things online. Overpayment scams are often initiated by someone sending you a counterfeit check or money order for a sum more than the amount outstanding on your account. After that, they will ask you to deposit the money in a bank and pay the difference back to you using a wire transfer. Unfortunately, because the check was forged, you may be liable for a returned check fee from the bank. You’ll also lose any payments you transferred to them, as well as any items you shipped to them.

It is possible that you will be targeted by an overpayment scam if you sell something online, as a business, or through classified advertisements. In most cases, the fraudster will contact you, make you an offer that is frequently fairly attractive, and then demand money via credit card or check from you.

They will be for a sum that is larger than the price that has been agreed upon. The fraudster will contact you to express regret for the overpayment and provide a fictitious explanation. You can be told that the additional money was provided to pay the agent’s fees or additional shipping expenses by the con artist.

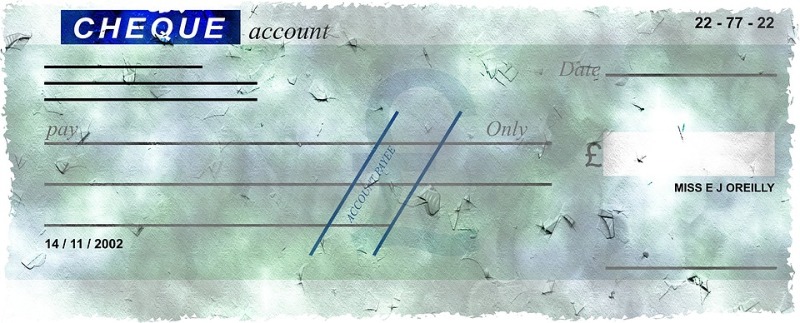

Alternatively, they might simply claim that they made a clerical error when writing the cheque. The fraudster will then ask you to refund the excess amount, or they will ask you to transfer the sum to a third-party account on your behalf. They will ask for this in the form of an online banking transfer, a preloaded money card, or a wire transfer such as one made through Western Union. When you check their bank account, you learn that their cheque has bounced or that their credit card has been stolen or forged.

Online sales, mainly through classified websites, are a recent twist on this scam in which the fraudster appears to have received payment for a bigger amount than agreed upon by issuing a bogus receipt of payment through services such as PayPal. The scammer will claim that the money is being kept until you send in the additional funds that have been requested. If you send any money, you will not be reimbursed in any way.

Even if you have already sent the ‘sold’ item, you will be unable to retrieve it. A minimum of the scammer’s actions will have been to waste your time and prevent you from accepting any legitimate offers on your property for sale.

2. Check-cashing scams

The check-cashing scam is yet another type of check-related scam. This swindle preys on the sympathy and kindness of others, preying on their vulnerabilities. Upon leaving a bank or other financial institution, a stranger approaches you and asks if you would be willing to cash their check for them. They may state that they do not have a bank account with this particular institution but that they require the funds.

You have the option of depositing the check and withdrawing cash from your account to give the individual their money. The clearing process, on the other hand, can take many days. The funds are therefore held against your account if the cheque is not cleared properly. If someone you don’t know writes you a check and then demands that you return the money, that is a fraud.

Fake checks come in a variety of shapes and sizes. They can take on the appearance of a company or personal checks, cashier’s checks, money orders, or electronic checks, among other things.

Here’s all you need to know about check forgery scams. During a phony check scam, a stranger asks you to deposit a check — sometimes for several thousand dollars and frequently for more money than you owe — and then pay a portion of the money back, either to them or to someone else.

The scammers always have compelling stories to tell in order to justify the overpayment. They can claim that they are stranded outside of the country, that they require your assistance in paying taxes or fees, that you will be required to purchase supplies, or something else.

3. Unsolicited check fraud

Is it possible that you’ve received a check in the mail that you weren’t expecting? It could be in the form of a rebate cheque or a refund for excess payment. Examine the check from top to bottom, paying special attention to any fine print on the front or back of the document. By signing and paying the check, there is a possibility that you are entering into a legally binding contract.

In order to obtain your authorization for memberships, loans, and other longer-term commitments that could end up costing you a lot of money, scammers employ deceptive tactics like these. Scammers are banking on you to take the cheque as free money and cash it without questioning your actions. If you receive a rebate or return check that you weren’t anticipating, don’t cash it.

4. Automatic withdrawal scams

Automatic withdrawals are a convenient way to automate your savings, bill payment, and other financial tasks. Automatic withdrawals are also popular with scammers, but for different reasons. It is possible to fall victim to this hoax by receiving a phone call or a postcard informing them that they have won a prize or qualified for a special offer.

The idea is to get you to read the numbers at the bottom of your personal checks off of your personal checkbook. They frequently justify this as a means of ensuring that you are eligible for the offer. Having obtained your checking and banking information, the scammer places it on-demand draught, which is processed similarly to a check but does not necessitate the use of a signature.

When your bank receives the draught, it will move money from your checking account to the scammer’s account to pay him. If you do not pay close attention to your regular bank activities, it is possible that you will not notice the fraud until it is too late.

Do you suspect that someone had scammed you?

If you have any suspicion of a scam or phishing attack, then you can rely on EZChargeback to help you with protection, mitigation, and fund recovery.

You will feel safe knowing that experts with years of experience will be guiding you!

5. Phishing scams

Phishing is a frequent fraud that, according to the FBI’s Internet Crime Complaint Center Report, caused victims a total of more than $48 million in losses in 2018. The way it works is as follows. A fraudster will send you an email message that appears to be from a reputable source, such as a bank, social networking site, or online store, for example. You should not respond to the email message.

The communication is an attempt to trick you into disclosing important and sensitive personal data, such as passwords, credit card numbers, and bank account information, to the sender of the message. For example, you can be sent to a website that appears to be authentic but was created solely for the purpose of collecting your personal information. Fake emails are frequently written in a hurry and with a sense of urgency.

Red flags include things like misspelled words, poor grammar, making urgent requests, and threatening financial consequences, as well as logos that don’t quite seem right. To determine if an email is authentic or not, open a new tab and navigate directly to the company’s official website — without clicking on any of the links contained within the suspected email. As a general rule, never click on links in these emails, never react to them, never seek to unsubscribe from them, and never provide personal information.

6. Government imposter scams

Another type of bank scam involves a fictitious government official posing as a bank employee. Your phone rings, and it’s the imposter calling to tell you that you’ve won a prize that requires you to pay taxes or fees before they can process your claim. Alternatively, the fraudster may threaten to send you to prison if you do not pay a purportedly unpaid bill.

Realistically speaking, you will never receive a phone call from a federal agency in which they ask for payment of any type. Scammers may use a fictitious federal agency name, such as the National Sweepstakes Bureau, or the names of legitimate federal agencies, such as the Federal Trade Commission, to defraud victims (FTC). No matter how you look at it, it’s a scam since this isn’t a tactic that federal agencies use to collect money.

7. Charity scams

Scammers often like taking advantage of people’s generosity by posing as charitable organizations. They call people and ask them to donate to a charity or a cause they believe in. Some scammers go to the extent of masking the phone number so that it appears as a local area code on your caller ID when you answer the phone.

Charity scams can sometimes be identified by the vague statements they make and the lack of specific ways in which your gifts are put to use. Scammers often enjoy creating fictitious names that sound similar to the names of actual charities.

8. Employment scams

Employee fraud is another typical method through which con artists attempt to get access to people’s financial accounts. In exchange for a one-time payment, the scammer guarantees to complete the work. They may also ask for your bank account details so that they can transfer commission money to you directly from their bank account.

However, this is all a ruse to obtain your bank account information in order to steal your identity. Job scams are most commonly sent by email, although scammers sometimes target people via phone and postal mail. In certain situations, job postings that turn out to be scams are approved by job search portals without their knowledge.

If you have been scammed by a banking scam then contact us to help you get your money back!

Safeguard Yourself from Falling Victim to Banking Scams!

The most effective method of avoiding having your bank account or other personal information compromised is to be proactive in controlling who has access to your information. Even though the potential scams described here are particular to banking, they are part of a bigger phenomenon known as identity theft. Because your bank accounts serve as the conduit via which you access and interact with so many elements of your financial life, scammers are ready to take advantage of any opportunities to exploit any vulnerabilities associated with your financial transactions.

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you