Key Practices To Identify A Crypto Scam!

A cryptocurrency is a digital, encrypted, and unregulated means of exchange. There is no national authority that administers and regulates the value of a cryptocurrency. Instead, these responsibilities are divided throughout the online world among some of the subscribers of cryptocurrency.

Even though most individuals trade in cryptocurrencies as they would in other investments such as shares or rare metals, you may use crypto to buy conventional goods and services. Although cryptocurrency is a new and exciting subject matter, investing in it can be dangerous, and therefore, you must undertake extensive research to comprehend how the system operates thoroughly.

A cryptocurrency is a form of technology commodity based on a solid distribution network across a massive number of computers. Cryptocurrencies are able to operate beyond the control of governments and central authorities due to their decentralized structure. According to experts, many industries, including finance and law, are expected to be disrupted by blockchain and associated technology.

Cryptocurrencies also have numerous advantages, like faster and less costly transfers of money and autonomous networks that do not have a point of failure. The fluctuation of cryptocurrencies, as well as the significant energy demand and their application in criminal activities, are all downsides.

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

If you are someone who’s interested in Cryptocurrency, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

10 Tips on Identifying Cryptocurrency Scams

1. Fact-Checking

It’s never a bad idea to double-check an offer that seems too good to be confirmed before committing. You’re probably falling for fraud if a dealer offers you ten times your money back with no explanation. So, if you don’t want to be a victim of a scam, pass on the transaction. There are also bogus mobile apps on the Internet that seem remarkably similar to legitimate cryptocurrency apps. Always look for ratings, customer reviews, and the integrity of logos to distinguish between fake and real programmers.

Always check for mistakes in URLs and web pages. In the world of cryptocurrencies, spoofing, which is one of the most popular technological attacks, is also common. Spoofing is a broad word for when a cybercriminal poses as a trustworthy entity or device in order to persuade you to perform something that benefits the hacker but is harmful to you.

Spoofing occurs when an internet scammer assumes another person’s identity. Make sure you’re only dealing with and buying with approved sites. Even if you’re following a link from a trustworthy source or a crypto specialist, keep an eye on whether you’re being diverted to a site you didn’t intend to visit.

Cybercriminals may construct phony bitcoin websites and applications with remarkably identical names to well-known and trusted services. Predators may be able to steal your identity or cryptocurrencies if you confuse these platforms for the real deal and enter your personal or account information. In some situations, you may incorrectly utilize the service to transmit your cryptocurrency directly to the scammers’ wallets.

2. Being on A Look-Out for Phishing

Criminals also use phishing emails that appear to be legitimate correspondence from a respectable cryptocurrency site or exchange to defraud users. Such emails usually include appealing offers and incentives to gain users. Fraudsters can also fool people by pretending to be technical support. For tech support and troubleshooting, always double-check the phone number, social media account, or email address that is being used to contact you – or that you are being approached with.

3. Protecting Your Identity

Many frauds do not rely on sophisticated technology or hacking. Instead, they focus on social engineering, which involves the attacker convincing you to share personal information or give money. Because cryptocurrency transfers are irreversible, victims may have limited options—all the more reason to use extreme caution.

Services that notify you if your personal information has been hacked in the event of identity theft could help keep your finances protected from criminal actors. Some services, such as Experian IdentityWorks, include identity theft insurance, which can assist to cover the time and cost it requires to rebuild your identity if it is stolen.

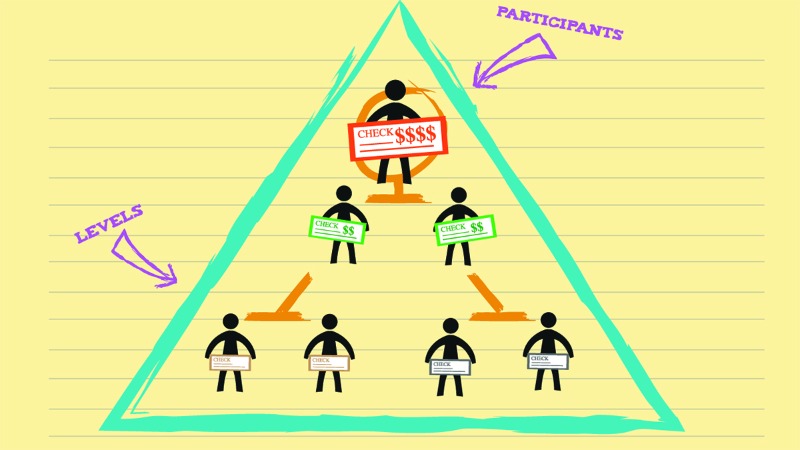

4. Be Aware of Pyramid Schemes

A pyramid scheme is a method used to deceive by obtaining the money that involves enlisting the help of an ever-increasing number of “investors.” The first promoters bring in investors, who bring in other investors, and so on. The system is described as a “pyramid” since the number of investors increases with each level.

People may appear nice and prepared to give their “advice” over the Internet, which is generally a deception to attract people to participate in their plan. According to the FTC investigation, some of these scams are built on referral networks (a sort of pyramid scheme) and work by attracting people who subsequently recruit new “investors.” Scammers ask customers to pay in bitcoin in exchange for the privilege to attract others into a program in exchange for cryptocurrency rewards.

5. Spotting Impersonations

Scammers are increasingly posing as a government agency or a company. Some consumers told the Federal Trade Commission that they deposited money into Bitcoin ATMs to pay imposters posing as Social Security Administration employees. Others have reported losing money to con artists posing as Coinbase, the leading bitcoin exchange, and wallet service in the United States.

It’s worth noting, though, that cryptocurrency was involved with only 14% of recorded online impostor losses. Fiat currency was used by a substantially bigger percentage of the time. This ratio, however, is likely to change: The cryptocurrency sector is exploding. If current patterns continue, the percentage of digital currency losses is expected to rise in the future years.

Scams and hackers affect businesses as well as individuals. The perpetrators of the July 2020 data breach of Ledger, a France-based crypto wallet provider, are still profiting from the attack’s victims. The names, email addresses, home locations, and phone numbers of 272,000 customers were leaked after the Ledger database was hacked. In an extortion campaign that “threatens users’ financial and emotional well-being,” fraudsters are now demanding payment in bitcoin from victims.

Large crypto corporations are hot targets, perhaps even more so than individual crypto users. Even firms like Ledger, despite being one of the leaders in cryptocurrency storage, are vulnerable to malevolent actors. Not only should you be cautious about who you send cryptocurrency to, but you need also be cautious about where you store it.

Do you suspect that someone had scammed you?

If you have any suspicion of a scam or phishing attack, then you can rely on EZChargeback to help you with protection, mitigation, and fund recovery.

You will feel safe knowing that experts with years of experience will be guiding you!

6. YouTube Crypto Scam Hacks

In accordance with a recent lawsuit filed by Apple co-founder Steve Wozniak, cryptocurrency fraudsters lurk on YouTube. The majority of the schemes involve phony bitcoin giveaways that are actually aimed to steal the virtual currency, as well as other types of cryptocurrencies, from users of the famous streaming video site. A YouTube Live deception features fraudsters posting a live video, posing themselves as a cryptocurrency authority, and linking directly to a “giveaway” in the video’s description, encouraging users to purchase cryptocurrency.

The scammers dodge YouTube’s copyright inspection procedure by using the Streaming option till the video is ended. The most efficient way to prevent this fraud, like all the others on social media, is to do your homework and ensure whether the page is legitimate or not.

According to Wozniak’s complaint, YouTube has displayed videos that exploit his material without his authorization in order to carry out the bitcoin scams. During the first six months of 2020, YouTube users lost $24 million in bitcoin and associated frauds, according to a July research by analytics firm Whale Alert. That’s an increase from the previous three and a half years’ total of $14 million. Therefore, it is essential that you are aware of the platforms you share your information on. However, this year, the amount of scam-related videos removed from YouTube has decreased considerably.

A YouTube spokeswoman attributed the drop to a variety of factors, including the company’s evolving enforcement methods. The site has been relying increasingly heavily on technology to police its platform this year, according to YouTube’s enforcement page, in part because of personnel challenges caused by the COVID-19 outbreak. About 400,000 of the 6 million videos removed by YouTube in the first three months of 2020 were removed as a result of a user complaint or detection by YouTube’s human enforcement team. This was down from nearly 2 million in the same time as the previous year.

7. Social Engineering Scam Hacks

Social engineering scams have been reported to have had a substantial influence on cryptocurrency users. The scammer usually begins by impersonating a victim and obtaining access to a phone or device that is linked to several accounts from a service provider. The scammer shuts out the victim as soon as access is allowed and grabs everything he can from the accessible accounts.

This is especially bad for cryptocurrency users because fund transfers are basically irrevocable. Aside from social engineering, there are more sophisticated risks on the horizon, especially as cryptocurrency usage becomes more prevalent. Attackers aren’t only going after wallets or persons; they’re infecting systems and gadgets with software to mine cryptocurrencies.

8. Social Media Scam Hacks

It’s investment fraud, with crypto-related fraud becoming increasingly prevalent. It’s on track to absorb social media whole if it continues to develop at its current rate. The Federal Trade Commission concluded in a new consumer protection research that social media sites, particularly Instagram and Facebook, have become the go-to spot for scammers to ply their trade.

Investment-related fraud is the most common con on social media in terms of money lost, yet online retail scams account for the majority of reports. In 2021, the FTC received reports of $770 million in losses from social media scams. In terms of monetary losses and the total number of fraud reports, there was a significant increase from 2017.

9. Twitter Scams Hacks

Hackers have previously succeeded in gaining access to Twitter accounts in order to increase the reach of their operations. Despite the large-scale size of the 2020 breach, hackers often get into smaller verified Twitter accounts and modify them to seem like other authentic accounts. Troy Stecher’s official check-marked Twitter account was hacked, modified to look like the “Saturday Night Live” Twitter feed, and then used for a hoax. Hackers will use these verified accounts to react to other high-profile accounts or viral tweets in order to gain more awareness.

10. Counterfeit Verified Accounts

Scammers also make use of trust signals on social media platforms, such as blue checkmarks on Twitter, to steal cryptocurrency. Scammers may utilize a blue checkmark in their profile photos or skillfully use the wallpaper to add a blue check in precisely the perfect spot to appear real. Similar marks can be found on real Instagram profiles; however, there are no pop-ups.

However, you may check the authenticity of an account by checking the number of followers and other signs. The real Mark Cuban has 1.7 million Instagram followers, whereas this fake account has only 31. However, this should not be taken at face value, as there have been cases where hackers have successfully breached Twitter’s security and disseminated crypto giveaway hoaxes via legitimate Twitter accounts belonging to high-profile individuals and companies. Kayne West, Barack Obama, Apple, and Uber were among them.

If your money was stolen from an investment scam then contact us to help you get your money back!

Crypto Scams are on The Rise & You Must Protect Yourself!

You’ll be able to recognize crypto-related deceit instantly and lessen the risk of it happening to you if you understand how hackers try to steal your information and, as a result, your money. Recognize the most common methods used by scammers to steal your personal information. It’s also vital to report scams to the platforms where they’re being perpetrated. If you come across a scammer posing as a bitcoin exchange agent, contact the exchange immediately. If you see someone spreading fraudulent giveaways, report them so that you and others can be protected from such deceptions.

Many in the cryptocurrency game are split on the subject of regulation. While state regulation may appear to go against the democratic philosophy of cryptocurrencies, it may defend traders and investors as well as dissuade criminal actors. Furthermore, more coordinated national policies on cryptocurrency could assist in regulating the industry and drive institutional adoption.

However, the only platform is highly vulnerable to scammers and potential threats, and therefore, a carefully driven and informed decision should always be taken when it comes to putting your personal information online as well as your investment.

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you