The Horrors That Scammers Do with Your Private & Confidential Debit Card Information?

When a fraudster tampers with an Automated Bank/Teller Machine (ABM/ATM) or Point of Sale payment terminal (referred to as a “debit machine”) to capture data from a payment card or Personal Identification Number (PIN), they commit debit card or credit card fraud. They then use the data to make purchases.

Debit cards are the ideal piece of plastic for many people. They provide many of the benefits of credit cards without the danger of building up debt. Debit cards, however, are susceptible to scammers, just like credit cards. Fraud using debit cards is also particularly terrifying since it allows fraudsters to take money right out of your checking account.

When a thief obtains your debit card number—and, in certain situations, your personal identification number (PIN), they might use it to make unauthorized purchases or take money from your account. This is known as debit card fraud. Your information can be obtained in various ways, including by unscrupulous employees and hackers using a retailer’s unsecured computer or network. Fortunately, spotting debit card theft doesn’t require any specialized knowledge.

Even though you may have your debit card safely tucked away in your wallet, someone could have already used it to withdraw funds from your bank account. Why might that occur? Sophisticated thieves employ various techniques to get your debit card details and take your money. There are techniques to thwart thieves, but doing so necessitates avoiding using your debit card in some situations.

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

Results show that fraudsters are shifting focus from account takeovers to scams where customers are exploited as a week link

KPMG 2019 Report

If you’re someone who wants to protect your financial transactions, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

The Dangers of Debit Card Fraud in 2022

Scammers Get Information Through Identity Theft - Debit Card Scam

Due to breaches in the data security systems of merchants and service providers, debit card fraud and related identity theft have recently happened throughout the world, causing financial harm and frustration to cardholders, banks, merchants, and service providers (card processors)

When cardholders learn that criminals have stolen their card information, including the PINs, and then produce counterfeit debit cards to empty their bank accounts, they become victims of debit card fraud and identity theft.

Debit card holders frequently had to pay penalties to retailers and banks for checks that bounced after a fraudster wiped out their account because debit cards are typically linked to checking accounts. The cardholder may be hit with late penalties or have a negative record placed on his credit report due to overdrafts brought on by fraudulent debits, according to the Public Interest Research Group (PIRG).

The good news is that most banks won’t hold a customer liable for unlawful transactions if he reports the institution promptly, according to the U.S. Federal Deposit Insurance Corporation.

Banks pay for the majority, if not all, of cardholder losses brought on by fraud. However, it is an expensive and time-consuming issue to look into suspicious activity involving their cardholders and find out when their debit cards are being used fraudulently.

Online Fraud Through Debit Cards & Information Stealing

You can use a debit card with or without a PIN. It is considered an “online” transaction when the PIN is utilized. Since both situations require a signature to be completed, using it without the PIN is regarded as an “offline” transaction comparable to using a credit card.

The Public Interest Research Group asserts that banks profit more when a customer uses an offline debit card and runs less risk. Additionally, banks profit more when a customer uses a debit (or credit) card rather than a check. The bank receives a fee or merchant discount from the business that accepts the card, which also reduces check-clearing expenses and float time (the time it takes for a check to clear).

As opposed to a flat cost of 7 1/2 to 10 cents for each online transaction with a PIN, the bank earns a percentage fee of up to 2 percent of the total value of every offline transaction. Another important source of income for banks comes from the fees they charge cardholders who use ATMs to withdraw cash.

Due to the recent widespread debit card fraud, banks will be forced to pay extra for returned checks if a sizable portion of customers stop using their debit cards and instead choose to pay for goods and services with checks or cash. Additionally, they will lose some of the substantial profits they currently receive from consumers who use their cards to withdraw money from ATMs and retailers.

They Will Steal Debit Card Information When You are Online Shopping

According to a survey conducted in 2022 by Raydiant, more than half of consumers in the United States would instead purchase online than in a physical store. However, there is no guarantee that buying online is a risk-free activity.

According to a report published by the Federal Trade Commission in 2021, fraudulent activities involving online shopping were the second most common type of fraudulent activity. Furthermore, the financial damages caused by these scams are increasing each year.

When buying online, it is essential to avoid providing personal information and debit card numbers whenever it is possible to do so.

According to John Buzzard, the lead analyst of fraud and security at Javelin Strategy & Research, “If you are using a browser to purchase items, make sure it is a merchant you trust that offers a payment option you feel comfortable with, like PayPal or some other encrypted payment option that maintains your payment card information without the need to key in data.”

If you have been scammed by an online scam then contact us to help you get your money back!

WORRIED THAT SOMEONE HAS YOUR PERSONAL & BUSINESS INFORMATION?

With how easy it is for scammers to acquire your data, it’s reasonable to be alarmed. Protect yourself and your loved ones by getting advice from experts.

We will guide and even help you get your money back from scammers.

Distraction Theft

Theft by distraction occurs when scammers who are skilled and versatile try to get your attention while you are taking money out of an ATM or when they pose as authoritative figures such as policemen or car park attendants to steal your debit card or cash. These scams can take place in a variety of settings. They employ a variety of strategies such as:

- While you are waiting in line or standing at the ATM, the person next to you is talking loudly and hurriedly.

- When working in pairs, one individual will try to distract you while the other steals your money from the machines.

- Someone standing extremely near you, drawing your attention to money lying on the ground, or asking you for instructions.

- putting a newspaper in your face and stealing cash from the machine while it is being dispensed

- It is essential to practice extreme caution and vigilance using an automated teller machine. If you have any doubts about the safety of an ATM machine or the actions of someone standing nearby, you should steer clear of using that machine altogether. If you are concerned that someone may have access to the information stored on your debit card, you should immediately cancel the card.

Card Skimming - Debit Card Information Stealing Technique

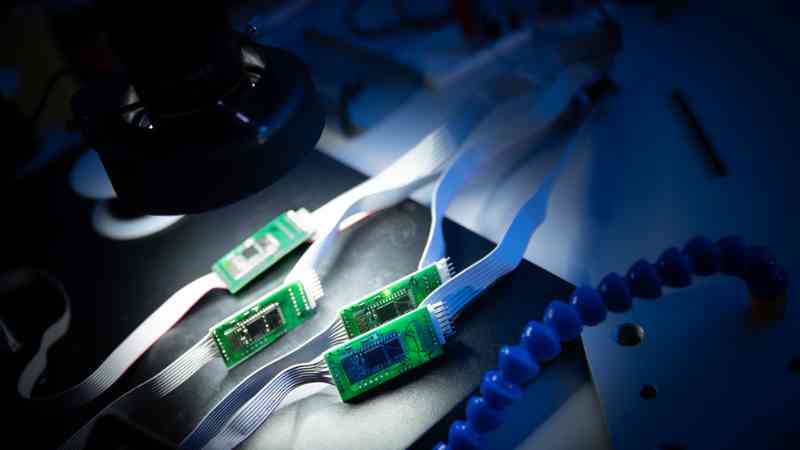

Criminals can skim debit cards by employing a tiny device that reads and retains the information contained on the magnetic strip on the back of the card. The card number, the date the card will expire, and the cardholder’s full name are all included in these details.

According to research conducted by Compare The Market in 2019, one in ten people have been targeted by this form of criminal activity, with victims losing an average of £846.

Thieves can make a copy of your card details by using any of the following methods:

- Put fake card readers over the slot where you enter your debit card information.

- Use hidden cameras to record your PIN code,

- Use a technique known as a “Lebanese Loop,” which locks your card within the machine and allows the criminal to retrieve it at any time.

- Fake keypads that read your personal identification number (PIN) and send it to the criminals remotely.

- Before placing your card into the ATM, you should first perform certain fundamental checks on the machine to protect yourself from the possibility of card skimming.

Contactless Debit Card Fraud

Only in the United Kingdom are approximately 700 million contactless card payments processed annually. A chip and an antenna are required to complete a transaction with a contactless debit card. Both components are necessary for the card’s functionality.

A signal is sent from the card reader to the chip on your card, which stores all of the information about your bank account. When you hold your card up to a card reader, this signal is sent to the chip. After that, the reader will process the payment, which can be up to a maximum of £100.

Due to the fact that fraudsters are unable to obtain all of the necessary card details needed to conduct online purchases, such as the CVV and name on the debit card, the use of contactless cards only accounts for three percent of the overall number of cases of fraud in the United Kingdom.

A card reader can really be used to process card payments via a person’s clothes or bag up to a value of £100 if the scammer stands close to the victim in a crowded area and processes the payment while the victim is distracted. This is one approach that scammers use. In addition, research that was carried out by Totally Money showed that one in every twelve consumers claimed that they wouldn’t be able to identify a missing £20 on their statement or balance.

You may safeguard yourself against fraudulent use of contactless cards by ensuring that you:

- Avoid leaving your debit card in pockets where it can be easily accessed.

- Keep your debit cards in the front pocket of your pants instead of the back.

- Applying tin foil to the inside of your wallet, purse, or cardholder will prevent any signals from reaching your card.

- When carrying on a conversation in a public place, you should exercise caution about the personal information that you make public, such as your full name, address, or date of birth.

Ways To Protect Yourself Against Debit Card Scams

To significantly lower your chances of becoming a victim of debit card fraud, adopt these simple habits:

- Be cautious when shopping and banking online. Only use private Wi-Fi on safe websites. Download a virtual private network to preserve your privacy if you have to shop or bank in a public place.

- Follow up on your accounts: Review your statements and sign up for text or email notifications to prevent debit card fraud.

- Don’t disregard warnings about data breaches: Most victims of identity theft were informed that there may have been a breach in their accounts but took no action. If you receive one of these messages, update your PIN and request that your provider changes your debit card number. A fraud alert can also be added to your records by requesting it from one of the leading credit card bureaus.

- Examine ATMs and card readers: Use caution when using card slots that appear dirty or have tampering indicators like scratches, glue, or debris. Also, avoid devices with odd directions like “Enter PIN twice.”

- Cover your card: Use your other hand to obscure the view as you use your debit card or enter your PIN at an ATM. If you see suspicious people loitering around the ATM, leave immediately. If your card gets stuck, contact the banking institution directly rather than accepting “help” from strangers.

Key Takeaways!

To conclude, when someone obtains access to your debit card—or your card information—and uses it to make unlawful transactions or withdrawals, this is known as debit card fraud. Anyone who uses a debit card should be aware of the warning signals and learn how to prevent debit card fraud because it is a severe crime.

Debit card fraud is more hazardous than credit card fraud since you carry a card that gives unauthorized individuals direct access to your bank account and personal information with few safeguards. Therefore, if you’re considering utilizing this as your main payment method, be aware that you do so at your own risk.

In general, you should call your bank right away to have your card canceled if it is lost, stolen, or you suspect any fraudulent activity. Do not forget to review your credit and debit card statements periodically for any atypical transfers or payments. It will be more difficult for thieves to steal your money if you are cautious and use caution when using your debit card.

Report any suspected credit or debit card fraud immediately to your local law enforcement, the FBI Internet Crime Complaint Center (IC3), or the Federal Trade Commission (FTC).

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you