Deep Dive into The Most Common Forex Scams & How Their Turmoil is Creating a Global Impact

Excerpt: When opening a bank account, make sure to read all of the fine print in the documents. When a trader attempts to withdraw funds from his or her account, the incentives offered to open the account are frequently used against him or her.

Introduction

The foreign exchange or forex market is highly volatile and carries significant risks. This market is not a good place to invest money that you cannot afford to lose, such as retirement funds, because you can lose most or all of your money very quickly. As of April 2019, the spot forex market, which includes currency options and futures contracts, was worth more than $6.6 trillion per day on average. Unscrupulous operators are attracted to forex scams because of the enormous amount of money floating around in an unregulated spot market that trades instantly, over the counter, and with no accountability. Forex scams offer the opportunity to make fortunes in a relatively short period of time.

While many once-popular scams have been put out of business as a result of aggressive enforcement actions by the Commodity Futures Trading Commission (CFTC) and the establishment of the self-regulatory National Futures Association (NFA) in 1982, some old scams have persisted, and new ones are constantly emerging. An old point-spread forex scam was based on computer manipulation of bid-ask spreads, and it was known as the point-spread scam. The point spread between the bid and ask price is essentially a representation of the commission charged by a broker in a back-and-forth trading transaction. Most of the time, the spreads between currency pairs are different. When those point spreads differ significantly between brokers, a scam can occur.

The foreign exchange market is highly volatile and carries significant risks. The stock market is not a good place to invest money that you cannot afford to lose, such as retirement funds, because you can lose most or all of your money very quickly. The Commodity Futures Trading Commission (CFTC) has seen a significant increase in forex trading scams in recent years and wants to advise you on how to identify potential fraud. Since tighter regulations were implemented, many forex scams have been reduced in prevalence, but there are still some issues to contend with.

Forex brokers who use wide bid-ask spreads on certain currency pairs are engaging in shady business practices, making it more difficult to make profits on trading transactions. Be wary of any broker who is based in an unregulated offshore jurisdiction. It is possible that individuals and businesses that market systems, such as signal sellers or robot traders, will sell products that have not been tested and will not produce profitable results. Commingling funds or restricting customer withdrawals could be signs that something is wrong with the forex broker’s business practices.

The foreign exchange market, also known as the over-the-counter market, is a global decentralized market for the trading of currencies. This market is responsible for determining the foreign exchange rates for all currencies. Buying, selling, and exchanging currencies at current or predetermined prices are all included in this definition of currency trading. Since more and more people, every single day, worldwide, are developing a keen interest in the forex market, it is important to learn about the various forex market scams that are a common activity these days so that you can safeguard your precious time and money. This article talks about what the forex market actually is, the various forex scams on the rise these days, as well as how you can prevent yourself from getting scammed. If that interests you, continue reading!

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

Over £27million lost to scams involving crypto and forex investments in 2018/19

Securities and Exchange Commission

If you’re someone who is into Forex Trading, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

CHAPTER 1: The Ins & Out of Forex Trading Scams

The term forex is a mashup of the words foreign currency and exchange. Foreign exchange is the process of converting one currency into another for a variety of reasons, most commonly in the context of commerce, trading, or tourism activities. For the first time in 2019, the Bank for International Settlements (a global bank for national central banks) published a triennial report estimating that the daily trading volume for forex reached $6.6 trillion in April 2019.

The foreign exchange market (also known as the forex market or the F.X. market) is a global marketplace for the exchange of national currencies between one another. Because of the global reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world, according to the International Monetary Fund. Exchange rate pairs are used for trading currencies against one another. For example, the currency pair EUR/USD is used for trading the euro against the United States dollar. Forex markets are available as spot (cash) markets as well as derivatives markets, which offer forwards, futures, options, and currency swaps, among other products.

For a variety of reasons, market participants use foreign exchange to hedge against international currency and interest rate risk, speculate on geopolitical events, and diversify their portfolios, among others.

The foreign exchange market is the place where currencies are bought and sold for a profit. Currency is important because it enables us to purchase goods and services both locally and across international borders, which is essential. To conduct international trade and business, it is necessary to exchange international currencies. If you live in the United States and want to purchase cheese from France, either you or the company from which you purchase the cheese must pay the French for the cheese in euros before the cheese can be shipped to you (EUR).

In this case, the importer from the United States would have to convert the equivalent value of U.S. dollars (USD) into euros (EUR). The same can be said for traveling as well. A French tourist visiting Egypt will be unable to pay for their visit to the pyramids in euros because the euro is not the local currency.

The tourist must exchange their euros for the local currency, in this case, the Egyptian pound, at the current exchange rate, which is determined by the government. One distinguishing feature of this international market is the absence of a central marketplace for foreign exchange transactions. Instead, currency trading is done electronically over the counter (OTC), which means that all transactions take place through computer networks among traders all over the world rather than through a single centralized exchange.

Traders can transact in currencies around the world at any time of day or night in the world’s major financial centers, which include Frankfurt, Hong Kong, London, New York, Paris, and Singapore, as well as Tokyo and Zurich. The market is open 24 hours a day, five and a half days a week, and currencies are traded in almost every time zone in the world. This means that when the trading day in the United States ends, the forex market in Tokyo and Hong Kong begins anew. As a result, the forex market can be extremely active at any time of day or night, with price quotes constantly changing.

A Brief History of The Forex Industry

Currency trading takes place on the foreign exchange market, which is a global decentralized (also known as over-the-counter (OTC) market) where currencies are traded between traders. This market is responsible for determining the foreign exchange rates for all currencies. Buying, selling, and exchanging currencies at current or predetermined prices are all included in this definition of currency trading. According to trading volume, it is the largest market on the planet, with only the credit market coming close behind it (see chart).

The major players in this market are the larger international financial institutions. Without exception, financial centers around the world serve as trading hubs for a diverse range of buyers and sellers, operating around the clock (with the exception of weekends) to facilitate transactions between them. Because currencies are always traded in pairs, the foreign exchange market does not determine a currency’s absolute value; rather, it determines a currency’s relative value by setting the market price of one currency if it is purchased with another currency. For example, one U.S. dollar is worth X Canadian dollars, or Swiss francs, or Japanese yen, and so on.

The foreign exchange market is mediated by financial institutions and operates on a number of different levels of sophistication. Banks rely on a small number of financial firms known as “dealers,” which are involved in large volumes of foreign exchange trading, to handle their foreign exchange transactions behind the scenes. Because the vast majority of foreign exchange dealers are financial institutions, this behind-the-scenes market is sometimes referred to as the “interbank market” (although a few insurance companies and other kinds of financial firms are involved).

Exchange trades between foreign exchange dealers can be extremely large, involving hundreds of millions of dollars in value. Because of the issue of sovereignty that arises when two currencies are involved, there is little (if any) oversight over the actions of the Forex market. The foreign exchange market facilitates international trade and investment by providing the ability to convert between different currencies.

For example, it allows a business in the United States to import goods from European Union member states, particularly Eurozone members, and pay in Euros, even though the majority of the company’s revenue is in United States dollars. It also encourages direct speculation and evaluation in relation to the value of currencies, as well as carry trade speculation, which is based on the difference between the interest rates of two currencies, among other things.

The Foreign Exchange Market Was in Full Swing During the 1970s

An example of a typical foreign exchange transaction is when one party purchases a certain amount of one currency by paying with a certain amount of another currency. During the 1970s, the beginnings of the modern foreign exchange market were laid out. This came after three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which established the rules for commercial and financial relations among the world’s major industrialized nations following World War II and was established in 1944.

Countries gradually transitioned away from the previous exchange rate regime, which remained fixed in accordance with the Bretton Woods system, and toward floating exchange rates. The characteristics mentioned below distinguish the foreign exchange market from other financial markets.

Because of its large trading volume, which represents the largest asset class in the world, the forex market has high liquidity. Other characteristics of the forex market include its continuous operation, which is 24 hours a day except on weekends, trading from 22:00 GMT on Sunday (Sydney) until 22:00 GMT on Friday (New York); the wide range of factors that influence exchange rates; the low margins of relative profit when compared to other fixed income markets; and the use of leverage to increase profit and loss margins. Due to this, despite the fact that central banks intervene in the market, it has been referred to as the market that comes the closest to the ideal of perfect competition.

Global trading in foreign exchange markets averaged $6.6 trillion per day in April 2019, according to preliminary global results from the 2019 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity published by the Bank for International Settlements. This represents an increase from $5.1 trillion in April 2016.

Foreign exchange swaps were traded more than any other instrument in April 2019, with $3.2 trillion in value traded per day, followed by spot trading with $2 trillion in value traded per day. The following is the breakdown of the $6.6 trillion: spot transactions totaled $2 trillion, approximately $1 trillion in outright forwards, foreign exchange swaps are worth $3.2 trillion, currency swaps worth $108 billion, options and other products worth $294 billion were traded.

In its most basic form, the foreign exchange market has been in existence for hundreds of years. Exchange of goods and currencies, as well as bartering, have always been used to purchase goods and services. The forex market, as we know it today, is, on the other hand, a relatively recent invention.

Following the collapse of the Bretton Woods agreement in 1971, more currencies were allowed to float freely against one another in the international financial markets. Individual currencies’ values fluctuate in response to changes in demand and circulation, and these fluctuations are tracked by foreign exchange trading services. Commercial and investment banks conduct the vast majority of forex trading on their clients’ behalf.

Still, there are also speculative opportunities for professional and individual investors to speculate on the value of one currency relative to another in the forex market. When it comes to currencies as an asset class, there are two distinct characteristics: you can profit from the difference between the interest rates of two currencies, and profiting from fluctuations in the exchange rate is possible. Profiting from the difference between two interest rates in two different economies can be achieved by purchasing the currency with the higher interest rate and selling it short of the currency with the lower interest rate.

It was very common to short the Japanese yen (JPY) and buy the British pound (GBP) prior to the financial crisis of 2008, owing to the significant interest rate differential between the two currencies. Carry trading is a term that is used to describe this type of strategy.

HAVE YOU BEEN SCAMMED AND NEED HELP IN FIGHTING BACK?

Scammers can create complex scams that can trap even the most cautious of people. But it’s not too late because we can help you track the damage done by scammers.

We can help you get your money back!

Currency Trading was Extremely Difficult

Prior to the invention of the internet, currency trading was extremely difficult for individual investors. Because forex trading requires a significant amount of capital, the majority of currency traders were large multinational corporations, hedge funds, or high-net-worth individuals (HNWIs).

With the assistance of the internet, a retail market geared toward individual traders has emerged, allowing them to gain access to the foreign exchange markets through either the banks themselves or through brokers who act as intermediaries in a secondary market. Individual traders can control a large trade with a small account balance because the majority of online brokers or dealers provide very high leverage to them.

Currency trading and exchange have been around since the beginning of time. At the time of the Talmudic writings, money-changers (those who assist others in changing money while also taking a commission or charging a fee) were active in the Holy Land (Biblical times). These people (sometimes referred to as “kollybits”) instead shopped at city stalls and, during feast days, at the Temple’s Court of the Gentiles.

Money-changers were also silversmiths and/or goldsmiths in more recent ancient times, as was the case in the ancient world. While the Byzantine Empire was in power during the 4th century A.D., the government maintained a monopoly on currency exchanges. The papyrus PCZ I 59021 (c.259/8 BC), which depicts the exchange of coinage in Ancient Egypt, was discovered recently. People could buy and sell items such as food, pottery, and raw materials in the ancient world because currency and exchange were important elements of trade in that time period.

By virtue of its size or composition, a Greek gold coin may contain more gold than an Egyptian coin. A merchant may be able to exchange fewer Greek gold coins for more Egyptian gold coins or more material goods in this situation. In order to account for this, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard such as silver or gold at some point in their history.

To act on behalf of textile merchants in foreign countries during the 15th century, the Medici family was compelled to establish banks in foreign countries to facilitate currency exchange. In order to facilitate trade, the bank established the “nostro” (from Italian, this translates to “ours”) account book, which contained two columned entries showing amounts in foreign and local currencies; information pertaining to the maintenance of a foreign bank account; and information pertaining to the keeping of a foreign bank account. During the 17th (or 18th) century, the city of Amsterdam was home to a thriving foreign exchange market. Agents acting on behalf of the Kingdom of England and the County of Holland conducted a foreign exchange transaction in 1704, according to historical records.

1850: The Incorporation of Alex, Brown & Sons

Alex, Brown & Sons began trading foreign currencies around 1850 and rose to become one of the country’s leading currency traders. Permission to engage in foreign exchange trading was granted to J.M. do Espirito Santo de Silva (Banco Esprito Santo) in 1880 after he applied for and received permission to do so. According to at least one source, the year 1880 marks the beginning of the modern foreign exchange, as it was the year in which the gold standard was instituted.

Prior to the First World War, there was much less control over international trade than there is today. Countries abandoned the gold standard monetary system as a result of the outbreak of World War II. Between 1899 and 1913, holdings of foreign exchange increased at an annual rate of 10.8 percent, whereas holdings of gold increased at an annual rate of 6.3 percent between 1903 and 1913, according to the World Gold Council. By the end of 1913, the pound sterling was being used in nearly half of all foreign exchange transactions around the world.

The number of foreign banks operating within the borders of London increased from three in 1860 to 71 in 1913, representing a tenfold increase. In 1902, there were only two foreign exchange brokers in the city of London. At the beginning of the twentieth century, currency trading was concentrated in three cities: Paris, New York City, and Berlin; Britain remained largely out of the picture until 1914. Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17, and by 1924, there were 40 firms that were engaged in the business of exchanging currencies in the city.

During the 1920s, the Kleinwort family was widely regarded as the world’s leading foreign exchange traders. Firms such as Japheth, Montagu & Co., and Seligman continue to hold significant positions in the foreign exchange market. The trade-in London began to resemble its modern manifestation as early as the 16th century. By 1928, the foreign exchange market was an integral part of the city’s financial operations. Individual attempts to achieve wholesale prosperity from trade for those living in 1930s London was hampered by continental exchange controls, as well as other factors in Europe and Latin America.

Bretton Woods Accord & Fixed Exchange Rates

The Bretton Woods Accord, signed in 1944, allowed currencies to fluctuate within a one-percent range of the currency’s par exchange rate, as long as they stayed within that range. The Foreign Exchange Bank Law was passed in Japan in 1954, and it is still in effect today. As a result, by September 1954, the Bank of Tokyo had established itself as a major center of foreign exchange. Japan’s foreign exchange laws were changed between 1954 and 1959, allowing for the trading of a much wider range of Western currencies. President Richard Nixon of the United States is credited with ending the Bretton Woods Accord and fixed exchange rates, which eventually resulted in the establishment of a free-floating currency system.

After the Smithsonian Agreement came to an end in 1971, the Smithsonian Agreement allowed interest rates to fluctuate by up to 2 percent per year. The volume of foreign operations carried out by the Federal Reserve of the United States was relatively low in 1961–62. Those involved in controlling exchange rates discovered that the boundaries of the Agreement were not realistic and so stopped doing so in March 1973, when none of the major currencies were maintained with a capacity for conversion to gold, and organizations instead relied on currency reserves to maintain their currency reserves in the interim.

It is estimated that the volume of trading in the market increased threefold between 1970 and 1973. At some point (according to Gandolfo, during the months of February and March 1973), some markets were “split,” leading to the establishment of a two-tier currency market, which featured dual currency exchange rates. This was abolished in the month of March in 1974. Reuters began using computer monitors for trading quotes in June 1973, replacing the telephones and telex machines that had previously been used.

The Bretton Woods Accord and the European Joint Float were both ultimately ineffective, and the forex markets were forced to close at some point between 1972 and March 1973. The West German government made the largest single purchase of U.S. dollars in history in 1976, achieving a total purchase of nearly 3 billion dollars in the process (a figure is given as 2.75 billion in total by The Statesman: Volume 18 1974). In response to this event, which demonstrated the impossibility of balancing exchange rates using the measures of control in use at the time, the monetary system and foreign exchange markets in West Germany and other European countries were closed for two weeks (during February and/or March 1973).

Following the purchase of Giersch, Paqué, and Schmieding, the company was forced to close “Brawley claims that “… 7.5 million Denmarks” have been earned. It was necessary to close the stock exchange markets. It was on March 1st that they reopened “In this case, a significant purchase was made after the close.

In developed countries, state control of foreign exchange trading came to an end in 1973, when the complete deregulation of the market and the emergence of the relatively free market conditions characteristic of modern times began. In accordance with other sources, the first time a currency pair was traded by a retail customer in the United States occurred in 1982, with additional currency pairs becoming available the following year. Following a series of reforms that began in 1978, the People’s Bank of China began allowing certain domestic “enterprises” to participate in foreign exchange trading on the first day of January 1981.

The South Korean government lifted currency controls at some point during 1981, allowing for the first time in the country’s history for free trade to take place. During the year 1988, the country’s government agreed to accept a quote from the International Monetary Fund for international trade. On February 27, 1985, the foreign exchange market was influenced by intervention by European banks (particularly the Bundesbank).

During the year 1987, the United Kingdom accounted for the greatest proportion of all trades in the world (slightly over one quarter). The United States was the second most active participant in international trade. The Iranian government changed the terms of some international agreements from oil barter to foreign exchange during the year 1991.

The fact that there are no physical buildings that serve as trading venues for the world’s forex markets is an interesting aspect of the markets’ operation. As opposed to this, it is a series of connections established through trading terminals and computer networks. Institutions, investment banks, commercial banks, and retail investors are all represented in this market by their respective positions. It is generally agreed that the foreign exchange market is more opaque than other financial markets.

Currencies are traded on over-the-counter (OTC) markets, where disclosures are not required. The presence of large liquidity pools from institutional firms is a common feature of the marketplace. One would expect that the economic parameters of a country would be the most important criterion in determining the price of its currency.

However, this is not the case. Following the results of a survey conducted in 2019, it was discovered that financial institutions’ motives played the most important role in determining currency prices. When people talk about the forex market, they’re usually referring to the spot market for foreign exchange. Companies that need to hedge their foreign exchange risks out to a specific date in the future tend to favor the forwards and futures markets over other types of financial instruments.

If your money was stolen from an investment scam then contact us to help you get your money back!

Forex Scams Came into The Mix

Foreign exchange fraud refers to any trading scheme that is used to defraud traders by convincing them that they can expect to make a large profit by trading in the foreign exchange market. Foreign exchange fraud can occur in a variety of ways. According to Michael Dunn of the United States Securities and Exchange Commission, currency trading became a common form of fraud in early 2008. The Commodity Futures Trading Commission is a government agency that regulates commodity futures trading.

When all is said and done, trading in the foreign exchange market is a zero-sum game, which means that for every gain made by one trader, another loses. Due to the fact that brokerage commissions and other transaction costs are subtracted from the results of all traders, foreign exchange is considered a negative-sum game in this context.

The Commodity Futures Trading Commission (CFTC) established a special task force in August 2008 to deal with the growing problem of foreign exchange fraud. A number of “improper practices” in the retail foreign exchange market, including “solicitation fraud,” “a lack of transparency in the pricing and execution of transactions,” “unresponsiveness to customer complaints,” and “the targeting of unsophisticated, elderly, low-net-worth, and other vulnerable individuals,” led to the CFTC proposing new rules in January 2010 that would limit leverage in the retail foreign exchange market to a factor of 10 to 1.

In 2012, Christopher Ehrman, a veteran of the Securities and Exchange Commission, was appointed to lead the new SEC Office of the Whistleblower. Unscrupulous activity in the non-bank foreign exchange industry has increased in recent years, according to the Commodity Futures Trading Commission (CFTC), which oversees and regulates the United States’ foreign exchange market. More than 80 cases were prosecuted by the CFTC between 2001 and 2006, involving the defrauding of more than 23,000 customers, who collectively suffered a loss of $350 million.

Between 2001 and 2007, approximately 26,000 people lost a total of $460 million in forex fraud. The foreign exchange market is a zero-sum game in which there are many experienced, well-capitalized professional traders (for example, those working for banks) who are able to devote their full attention to trading on a daily basis.

Retail traders who are new to the market will be at a significant information disadvantage when compared to these traders. Retail traders are undercapitalized in comparison to other businesses. As a result, they are vulnerable to the problem of gambler’s ruin: in a “fair game” (i.e., one in which there are no information advantages), the player with the lower amount of capital has a higher probability of going bankrupt than the player with the higher amount of capital. The retail trader is always required to pay the bid/ask spread, which reduces their chances of winning to those of a true game of chance.

Additional costs may include margin interest or, if a spot position is held open for more than one day, the trade may be “resettled” on a daily basis, with each “resettlement” incurring the full bid/ask spread each time. Occasionally, in some variations of forex trading, customers do not obtain standard fungible futures contracts but rather enter into a contract with a specific company. Even if the company claims to act as their “forex dealer,” the company has a vested financial interest in seeing that the retail customer loses money on their purchase. Because the contract is directly between the customer and the pseudo-dealer, it is classified as an off-exchange contract, which means it cannot be registered with or traded on traditional futures exchanges.

The fact that some experts have been successful in arbitraging the market and earned an unusually large return does not imply that a larger number of experts could earn the same returns, even if they had access to the same tools, techniques, and data sources as they have. As a result, the arbitrages are essentially drawn from a pool of finite size; while information about how to capture arbitrages is a nonrival good, the arbitrages themselves are considered rival goods. Consider the following illustration: no matter how many treasure hunters purchase copies of the treasure map, the total amount of buried treasure on an island remains constant.

Identifying These Forex Scams Like a Pro

The following characteristics of the foreign exchange market make it vulnerable to fraud: There is no centralized exchange that is regulated. Over-the-counter (OTC) trading refers to currency trading that takes place over computer networks between traders rather than in person (OTC). The foreign exchange market is characterized by high levels of leverage.

In essence, the broker is lending the trader money, allowing the trader to engage in risky trading practices on margin. Based on the amount of currency being traded, a typical margin ratio will be in the range of 50:1, 100:1, or 200:1, respectively. At a 100:1 leverage, the trader only needs to put up £1000 to cover a trade worth £100,000 in profit.

The reason why Forex brokers are able to offer such high leverage is that currency fluctuations in the Forex market are rarely greater than 1% during any given trading session. When the market is experiencing only minor fluctuations, high leverage attracts inexperienced traders who may believe that the Forex market is a get rich quick scheme.

Individuals who want to avoid being scammed should first learn how to trade on the foreign exchange market properly. This is the single most important thing they can do. This is made more difficult by the fact that it is difficult to find trustworthy Forex brokers and Forex teachers who can be relied upon. The novice must be certain that the broker has actually made the money that he or she claims to have made; due diligence is essential in this situation.

The Forex market is not a game of chance but rather a very serious market where trillions of dollars worth of currency units are traded every day. Before you start trading with real money, practice on demo accounts to learn how to make long-term profits. Be aware that, as with any professional skill, mastering the Forex trade takes years of practice and dedication. Anything that claims that you can make money quickly should be avoided at all costs. In fact, Paul Belougour, managing director of a retail

Forex trading company, has gone so far as to say that “if this is money you have worked hard for – and that you cannot afford to lose – you should never, ever invest in forex.” Do not accept the claims made at face value; instead, put in the effort to conduct your own investigation. When trading for the first time, novice traders should be critical in their approach, analyzing statistics and developing their own functions that they have tested and found to be successful on a demo account before moving forward.

This will take time to accomplish, but it will benefit the inexperienced trader more than relying on a computer programme that is programmed to trade for them. Do not be enticed into making an investment that appears to be “too good to be true.” The authenticity of the company making the claims or selling the expertise/course are two other things that a person might want to look into as well. Examine the location or jurisdiction where the company is registered, as many Forex scammers will trade from a location where they believe the local law will make it difficult for them to be prosecuted internationally.

CHAPTER 2: The Most Common Types of Forex Scams in Today’s Market

While most Forex trading occurs in the spot F.X. market, which differs from the futures market in that currencies are physically exchanged in real-time when a transaction is completed, the spot F.X. market accounts for the majority of all trading in the forex market. In contrast, in the futures market, the date on which the trading price is determined and the date on which the currency is exchanged are two completely different dates. By going to their bank and exchanging currencies, a traveler is taking part in the spot foreign exchange market.

WORRIED THAT SOMEONE HAS YOUR PERSONAL & BUSINESS INFORMATION?

With how easy it is for scammers to acquire your data, it’s reasonable to be alarmed. Protect yourself and your loved ones by getting advice from experts.

We will guide and even help you get your money back from scammers.

Signal Seller Scams

When a person or company sells information on which trades to make, they are committing a scam. They claim that the information they are selling is based on professional forecasts that will ensure profits even for the least experienced traders. This is known as the signal seller scam. For this service, they typically charge a daily, weekly, or monthly fee, but they do not provide any information that will assist the trader in making money.

A large number of testimonials from purportedly legitimate sources will usually be provided in order to gain the trader’s confidence, but in reality, they will do nothing to forecast profitable trades. Many traders rely on seller signals to make their decisions. They provide information about the state of the financial markets and are the most accurate tool available to the market for making accurate predictions about future trading performance.

For traders, it is now possible to purchase information products that contain purportedly useful indicators for determining which direction to trade. The fact that this is true is something scammers take advantage of. Some scammers create a series of falsified signals that appear to be legitimate but, in reality, lead a trader down the wrong path in a way that is only profitable for the broker in question.

As a result of the high demand for signals in the market, forex investors must exercise caution to avoid becoming victims of a type of fraud known as a ‘signal selling scam.’ It is possible to commit this type of fraud because of the increased dissemination of false information as well as technological advancement. This article will discuss the dangers of being a victim of a forex signal seller scam, as well as some helpful hints on how to reduce the likelihood of becoming a victim.

This particular brand of forex scam has the potential to victimize a wide range of traders, and it is unwise for any trader to assume that they are immune from falling victim to it. Those who have been involved in the foreign exchange market for a long period of time will have a better understanding of what information is legitimate and what information is not legitimate. Those with little or no prior forex experience, on the other hand, are the most vulnerable.

When starting out at the very bottom of the forex trading ladder, traders may be more willing to take risks, putting themselves at greater risk of losing their investment. There is no one set way for a signal-selling scammer and a potential victim to come into contact, but there are some well-known routes that they can take to get their message across. A fraudulent organization selling signal information will almost certainly set up a website, which it will then list and advertise online as a seemingly legitimate source for forex tips and signals.

Another option is to find customers through social media platforms such as Instagram, where it can even showcase the lifestyle that a trader can achieve through the use of the signal service. Once a scammer has identified a potential victim, the next step is usually to persuade the customer to sign up for the service and pay a significant monthly or weekly fee in exchange for its use, according to the scam. A seasoned trader will most likely be able to determine the quality of signals generated by the organization through technical or fundamental analysis, depending on their experience.

A new trader, on the other hand, might not. This will likely make the new trader more vulnerable to the organization’s enticing tactics in the future. One of the most common characteristics of a signal selling scam is the creation of conditions in which the trader assumes that a system’s past successes are an indication of the system’s value.

Scam artists in this field take advantage of this to prey on unsuspecting traders while also producing statistics that show the alleged ongoing success of a particular system. The fact that these successes have been sustained in the long term is not guaranteed — and if there is no disclaimer to this effect published on the organization’s website, there is a good chance that this is a red flag and that the provider should not be trusted.

The use of signal information products is certainly not required. You can learn a lot about self-teaching with the help of tutorials. The most important factor to consider here is whether or not a trader is willing to put in the effort to increase their knowledge and awareness. It’s also a good idea to read customer reviews about your preferred provider. If a signal provider has been in business for a long period of time, it is likely to have received some positive feedback about its services from customers on the internet.

If you do a simple Google search, you should be able to locate them fairly quickly. Signal selling happens to be a legitimate business, which is one of the primary reasons why so many investors are taken advantage of by scammers. Organizations that are genuine and legitimate, as well as those that provide useful and legitimate information, exist. The result may be a confusing situation, to say the least. Forex signal seller scams, in contrast to many other types of forex scams, are a little more difficult to detect because there are legitimate, non-fraudulent providers in the mix.

For traders, the most important thing they can do to avoid falling victim to signal selling fraud is to ensure that they approach it with the appropriate attitude. To reduce the likelihood of falling victim to a signal seller scam, traders should question and scrutinize each and every trading opportunity, as well as determine who truly benefits from the trade. In the specific case of avoiding a signal seller scam, choosing to perform personal signal analysis on price charts rather than relying on an external provider is a good alternative to relying on an external provider.

It is also worthwhile to conduct due diligence on potential signal providers to ensure that they are legitimate and operate at the top of the market. When it comes to determining legitimacy, one method is to look at provider websites, while another is to read and evaluate online provider reviews.

At the end of the day, it is up to the individual trader to determine how valuable the signal selling service is to him or herself. In the absence of a crystal ball, signal selling services and the outcomes they predict cannot be guaranteed or relied on to be accurate. The choice of the service provider is entirely up to the trader, provided that he or she has amassed sufficient prior knowledge and has conducted as much research as possible

Forex Robot Scams

When it comes to investing, there are a plethora of ways to defraud an investor. For a period of time, many brokers are able to get away with their fraudulent activities without being caught. Later, one of two things happens: they are either “caught” by a regulatory organization, or they manage to flee with their clients’ money, never to be seen again.

The Forex robot is the most recent entry into the Forex scam market, and it is a perfect example of how promises of easy money can be deceived. Forex Robots are designed to generate income while you sleep, which makes them a prime target for criminal activity and money laundering. Forex robot scams are only now beginning to be exposed, but not everyone believes that Forex robots are scams in the first place, as some believe.

Forex robot scammers entice novice traders with the promise of large profits with little effort or knowledge on their part. They may employ deceptive or misleading figures in order to persuade customers to purchase their product. Their claims are untrue because no robot can adapt to and thrive in all environments and markets, as has been demonstrated. Professionals typically use the software only to analyze past performance and identify trends, which is a limited application.

All software should be formally and independently tested, but it is important to exercise caution when relying on the reviews themselves because these can be purchased for a price. Because if their product did everything they claimed it could do, they would not sell it and instead would use it exclusively for their own purposes.

Forex robots, also known as Expert Advisors (EAs), are software programs that claim to be able to automate foreign exchange trades. It’s the equivalent of putting a plane on autopilot. It is possible for traders to sleep peacefully at night, knowing that their trades will be executed exactly at the times they have specified. It appears to be straightforward, doesn’t it? Foreign exchange robots have been receiving a lot of attention lately, and Forex robot scams aren’t too far behind them.

Almost every Forex broker now provides its account holders with the option of using a Forex robot to execute their trades on their behalf. They back up the legitimacy of these robots with enormous profits and lull the trader into a false sense of security, only for him to go bankrupt in the end. These claims are typically based on a very narrow window of time during which the particular product was successful rather than on long-term use of the Forex robot.

A Forex robot can only be as intelligent as the person who created it. It is the intention of the creators of these systems to make a large sum of money quickly, and they do not take into consideration that the most predictable thing about the Forex market is the changes that cannot be predicted without paying close attention to the changes themselves. Anyone who is well-versed in and understands the Forex market will recommend a live person who employs their own trading strategy, and only then will it make sense to automate any of the processes mentioned above.

The companies that manufacture Forex robots frequently rely on very broad, small print disclaimers to keep them out of trouble when they promise astronomical returns that are unrealistic in the long run. The problem is that Forex robots are programmed to operate on the basis of automated mathematical algorithms, which do not take into account factors such as market conditions, which fluctuate in response to political events, weather, and other factors. A robot cannot program the market’s inconsistency, so the results of Forex robots are also unpredictable.

In order to obtain these robots, one does not need to rely on a Forex broker because Forex robots are readily available for purchase online. It is even available for purchase on Amazon.com under the title “Make Money While You Sleep – Advanced Forex Auto Trading Robot,” which is a software package made available by one Forex company. Because the cost of a robot program is typically around $1000 for the entire package, most traders choose to use the E.A. provided by their Forex broker instead. This is one of the factors that contribute to the prevalence of Forex robot scams.

When you examine any two profitable trading weeks from the past and then make a profit claim based on those weeks, you are not deceiving anyone. In order to ensure that they are not lying, these Forex robots claim their profitability based on any given successful time period in their past when testing the product. In simulated conditions, be extremely skeptical of claims of hindsight. Because 99 % of traders who purchase a robot end up requesting a refund, most experienced Forex traders advise against investing in one in the first instance.

For the sake of objectivity, Forex traders recommend that you never use a Forex robot on a live, real-money Forex account until you have thoroughly tested it on a demo account first. If the Forex vendor is genuine, he should advise his customers not to use an E.A. until they have fully comprehended what the robot is all about before proceeding. A refund for the Forex robot may occasionally satisfy the customer, but by that time, the customer has already suffered a loss in the market and wishes that they had never gotten involved with it in the first place.

Trading forex robots in the past has led some traders to recommend that traders learn enough about the workings of the E.A. programme so that they can place trades directly with the robot rather than going through a broker. These actions will give them the impression that they are in command of their money and are not entrusting it to the care of a third-party broker. Despite the fact that this will not result in profits, it will eliminate the feeling of having been duped by a fraudulent Forex robot scam.

One practical example of a Forex robot is the Vader Forex robot, which is a product developed by a technology company that specializes in Forex trading. This particular Forex robot has demonstrated excellent performance, is user-friendly, and incorporates Fibonacci levels to aid in the prediction of market trends. This Forex robot uses Fibonacci retracements as entry and exit thresholds for automated Forex trading because some traders consider the accuracy with which Fibonacci retracements can predict future rates to be very significant.

The people who use this Forex robot believe that it is a powerful strategy that can predict results with a reasonable degree of accuracy. In some cases, reviews have indicated that it can perform more successfully when used by someone who performs some of the monitoring themselves rather than relying solely on automated decisions.

Forex Broker Scams

If you conduct a search on the internet for “forex broker scams,” you will be overwhelmed by the number of results. While the forex market is gradually becoming more regulated, there are still a large number of unscrupulous brokers who should not be allowed to continue operating. When looking to trade forex, it’s critical to identify brokers who are dependable and financially viable and to avoid brokers who are not so reliable and financially viable.

Before depositing a large amount of capital with a broker, we must go through a series of steps in order to distinguish between strong and weak brokers, as well as between reputable brokers and those engaged in shady business practices. The act of trading is difficult enough in and of itself, but when a broker implements practices that work against the trader, making a profit can become virtually impossible. A lack of response from your broker may be a red flag that they are not looking out for your best interests in the transaction.

Prepare yourself by conducting research, checking for complaints, and carefully reading the fine print on all documents to ensure you are not being taken advantage of by an unscrupulous broker. Try opening a mini account with a small balance first and then trading for a month before attempting a withdrawal from the account you just opened. If you notice buy and sell trades for securities that do not correspond to your objectives, it is possible that your broker is churning. If you find yourself stuck with a bad broker, go over all of your documents and discuss your options with a trusted friend or family member before taking more drastic measures.

When looking into a potential forex broker, traders must learn to distinguish between fact and fiction in their research. In the case of a broker, we could conclude that all traders fail and never make a profit based on the various forum posts, articles, and disgruntled comments that have been posted about them. Traders who fail to make profits then post content on the internet in which they accuse the broker (or some other outside influence) of being responsible for their own losses.

DO YOU NEED EXPERT ADVICE?

We have encountered victims who were mentally and emotionally drained when they were scammed out of their money.

We can help you with your legal and technical concerns and we can help you get your money back.

Rookie Traders

It is also possible that new forex traders will struggle to trade with a strategy or trading plan that has been tried and tested. Instead, they place trades based on psychological factors (for example, if a trader believes the market must move in one direction or the other), and there is a 50% chance that they will be correct in their predictions. When a novice trader enters a position, it is common for them to do so at a time when their emotions are waning.

Experienced traders are aware of these junior tendencies and are quick to intervene, reversing the trade’s direction. Because of this, novice traders are perplexed. They begin to believe that the market—or their brokers—are out to get them and take their individual profits from them. The majority of the time, however, this is not the case. It is simply a failure on the part of the trader to comprehend the dynamics of the market.

Broker Failures

Losses can be attributed to the broker on rare occasions. This can happen when a broker tries to rack up trading commissions at the expense of the client’s account. Brokers have been accused of arbitrarily moving quoted rates in order to trigger stop orders when other brokers’ rates have not moved to the same price as the quoted rate.

Fortunately for traders, this type of situation is an outlier and is not likely to occur again in the near future. It’s important to remember that trading is rarely a zero-sum game and that brokers make the majority of their money from increased trading volumes. Brokers benefit from having long-term clients who trade regularly and, as a result, help them to maintain their capital or make a profit on a consistent basis.

Behavioral Trading

The problem of slippage can frequently be traced back to behavioral economics. It is common for inexperienced traders to panic when they encounter a difficult situation. They are concerned about missing a move, so they press the buy key, or they are concerned about losing more money, so they press the sell key. It is impossible for the broker to guarantee that an order will be executed at the desired price in volatile exchange rate environments.

As a result, there are abrupt movements and slippage. Similarly, stop-loss and limit orders operate in the same way. Some brokers guarantee the filling of stop and limit orders, whereas others do not guarantee order fills. Markets move, slippage occurs, and we don’t always get the price we want, even in more transparent markets like stock markets.

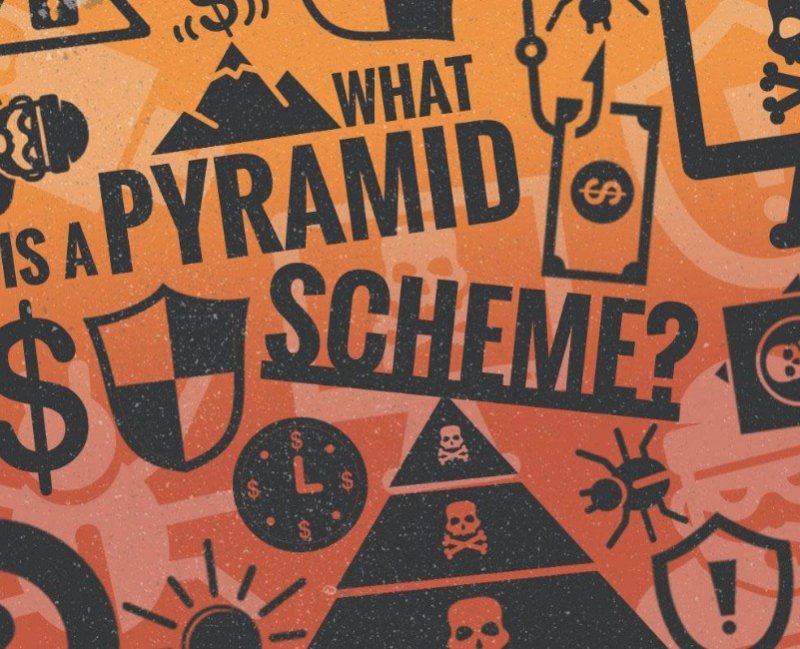

Forex Pyramid Scheme

These are some of the most common types of affinity fraud. In exchange for a small initial investment up front, they promise high returns. Early investors almost always see some sort of return on their investment and motivated by their success, they go out and recruit their friends and family to participate in the scheme as well. Truth be told, the ‘investment opportunity’ does not actually exist, and the money used to fund their initial return comes from other members of the scheme who have contributed money to the scheme.

After a certain number of investors withdraw their funds, the scammers close the scheme and pocket the money. Forex trading is the world’s largest financial market, with trillions of dollars in transactions taking place every day between large corporations and individual investors. Because of the internet and computer technology, the forex market is now accessible to the general public through the use of a forex broker online. If you’re wondering, “Is forex a pyramid scheme?” you’re not alone.

However, pyramid schemes have been developed in the forex market, just as they have been developed in the stock market, real estate, and virtually any other legitimate type of financial investment. For the most part, people will search for the best forex broker, open a forex trading account, and begin practicing forex trading strategies. Unfortunately, a small number of people will attempt to take the easy way out in order to become wealthy quickly through forex trading and will end up being scammed.

When it comes to life, there is a rule that you will follow when considering a foreign exchange investment. “If something appears to be too good to be true, it almost certainly is.” The one thing that all forex scams have in common is that they all promise unreasonably high returns on investment. The forex market has the potential to generate large returns, but there is always a risk of losing money. As a result, if someone promises a large amount of upside with little or no downside, it is most likely a scam.

If someone had a foolproof method of trading forex, why would they ever want to share it with the rest of the world? They would keep it to themselves and make a fortune in the forex market. And let’s just say there was some extremely generous trader who decided to share this guaranteed trading method with the entire trading community in a massive act of generosity – everyone would have heard about it and would be using it.

Pyramid schemes make money by recruiting new paying members to join the scheme and thus increasing its overall revenue. Rather than making money from forex trading, the owner of the Forex Pyramid Scheme makes money from the fees that new forex investors pay in order to become a member of the pyramid scheme. Because of this second layer of recruits to the scheme, it is referred to as a pyramid because they will then hire even more new recruits for a third layer of investors.

When new investors join, the higher up the pyramid you are, the more money you make as a result. Pyramid schemes are illegal, and those who initiate them are typically sentenced to prison time if they are discovered. Ponzi schemes are essentially forgeries of real investment management firms. Instead of paying a fee, as they would in a Pyramid scheme, people will put their money into the scheme and earn interest.

The owner of the scheme will entice investors to make investments with a forex guru of some sort, who is typically referred to as a ‘forex money manager.’ In reality, there are many real forex money managers who trade a pool of clients’ money on their behalf, charging them a fee as well as a percentage of the profits. The difference between a Ponzi scheme and other investment schemes is that there is no investment in a Ponzi scheme.

The scheme will pay out early investors not from any returns on their investments but rather from the money invested by later investors, according to the terms of the scheme. If there are always new investors, the scheme will be able to operate indefinitely. The most well-known case in point is that of Bernie Madoff.

Managed Forex Account Scam

DO YOU SUSPECT THAT SOMEONE HAD SCAMMED YOU?

If you have suspicions of a scam or phishing attack, you can rely on experts to help you with protection, mitigation, and fund recovery.

You will feel safe knowing that experts with years of experience will be guiding you!

When an investor “invests” with a “professional” trader, the scammer trades the investor’s capital for a percentage of the profits made by the trader. If you are a beginner who has no idea what they are doing or does not have the time to learn, this may sound particularly appealing to you. Frequently, when funds are transferred from managed accounts to unrelated luxury items such as cars and islands, the manager takes the funds and spends them.

When the manager is finally apprehended, he is unable to repay the entire amount of stolen capital, resulting in dissatisfied clients and multi-million dollar lawsuits against him. Not all managed accounts, on the other hand, are bad. It is true that some traders have many years of trading experience and are well-qualified to trade with real money, but this is more of an exception than the rule.

CHAPTER 3: Blacklisted Companies To Stay Aware of In The Forex Market

Unfortunately, fraud can be found in any commercial setting, and the Forex market is no exception to this rule. Although sleazy Forex brokers continue to defraud unsuspecting traders well into the year 2022, the good news is that this is no longer the general trend but rather one that is on the decline. There are a variety of primary reasons for this shift.

Today, Internet users are responsible for keeping blacklists of Forex scam brokers up to date and publishing them on a regular basis. Our portal is no exception to this rule. After collecting information on scam brokers for more than a decade, we believe we have identified every dishonest company operating in the marketplace. Forex scam brokers are not always represented by the brokers who are committing fraud. Most of the time, they are individual players who do not have corporate structures but who position themselves as broker companies.

They are frequently very experienced Internet users who are capable of fabricating false information for inclusion on the website they have created. The proprietors of such scam websites do not hold a valid license and, as a result, are not subject to proper regulation. They may not even have a basic understanding of the foreign exchange market at times.

However, for a novice trader who has not received a formal education in economics or finance, not everything is as straightforward as it appears. Suppose a visitor comes across an attractively designed website with lucrative profit promises and words or phrases like “spread” and “immediate execution of orders,” all of which pique his or her interest.

For the uninitiated, this could give the appearance of legitimacy to the dishonest website. Because of this, a person signs up, makes a deposit — and this is where the most interesting part begins — and then there is the technology’s deception on them. Fly-by-night brokers, forex bucket shops, and pyramid schemes are the three types of Forex scam brokers that are typically included on blacklists of Forex scam brokers.

Some of the blacklisted forex trading companies include: 24FX (2014), 24options (2018), 4XP (2012), 770capital (2021), ACFX (2016), Adamant Finance (2021), AGM Marketers (2018), and AXEForex (2017) among many.

CHAPTER 4: How to Safeguard Yourself Against a Forex Scam?

When communication between a trader and his or her broker begins to break down, real problems can begin to develop between them. This is a common red flag that indicates that a broker is not looking out for their client’s best interests. If a trader does not receive responses from their broker or receives vague answers to their questions, this is another common red flag that indicates a broker is not looking out for the client’s best interest.

It is important for issues of this nature to be resolved and explained to traders, and it is equally important for brokers to be helpful and demonstrate good customer relations. One of the most detrimental issues that can arise between a broker and a trader is the trader’s inability to withdraw money from his or her account when the broker refuses to allow it.

It is preferable if you can avoid dealing with unscrupulous brokers in the first place. Look for customer reviews of the broker on the internet. A general internet search can provide insight into whether negative comments are the result of a disgruntled trader or if there is something more serious going on. BrokerCheck, provided by the Financial Industry Regulatory Authority (FINRA), is a useful supplement to this type of search because it indicates whether or not there are any outstanding legal actions against the broker in question. Additionally, if necessary, gain a better understanding of the regulations governing forex brokers in the United States.

Examine the situation to ensure that no one has complained about not being able to withdraw funds. Ascertain whether or not there are any complaints by contacting the user and asking them about their experience.

Equip Yourself To Ward off Forex Scams

When opening a bank account, make sure to read all of the fine print in the documents. When a trader attempts to withdraw funds from his or her account, the incentives offered to open the account are frequently used against him or her. Consider the following scenario: A trader deposits $10,000 and receives a $2,000 bonus; however, the trader loses money and attempts to withdraw some of the remaining funds, the broker may inform the trader that they are unable to withdraw the bonus funds. Reading the fine print will assist you in ensuring that you are aware of all contingencies in these types of situations.

Upon completion of your research on a particular broker, you should open a mini account or a small amount of capital with that broker. After trading it for a month or more, you should try to cash out your winnings. If everything has gone smoothly, it should be relatively risk-free to add more funds to the account. If you are experiencing difficulties, make every effort to communicate with your broker. Happy trading!

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you