How to Avoid A Pyramid Scheme with Maximum Safety & Security

A pyramid scheme is a dangerous and unsustainable business approach in which a limited number of top-level members attract newer members through a series of steps. Those who joined them pay a fee to those who enrolled them in advance. As newer members recruit their own underlings, a percentage of their subsequent fees is passed up the chain. Several countries have outlawed what are known as “pyramid frauds.”

This article is being written to make you aware of the fraudulent scheme known as the pyramid scheme. We will delve into how these schemes work and how you could save yourself from being a victim to such Ponzi schemes.

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

The rising use of virtual currencies in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes in which these currencies are used to facilitate fraudulent, or simply fabricated, investments or transactions.

Securities and Exchange Commission

If you are someone who’s interested in investments and trading, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

Salient Information Regarding the Ponzi Scheme

- Pyramid schemes are generally connected with fraudulent activities because they feed earnings from lower levels of a company to the top.

- The great majority of pyramid schemes benefit through recruitment fees and rarely include the sale of tangible goods or services.

- Multi-Level Marketing (MLM) operations are similar to pyramid schemes in nature, but they vary in that they sell physical commodities.

How Does a Pyramid Scheme Work?

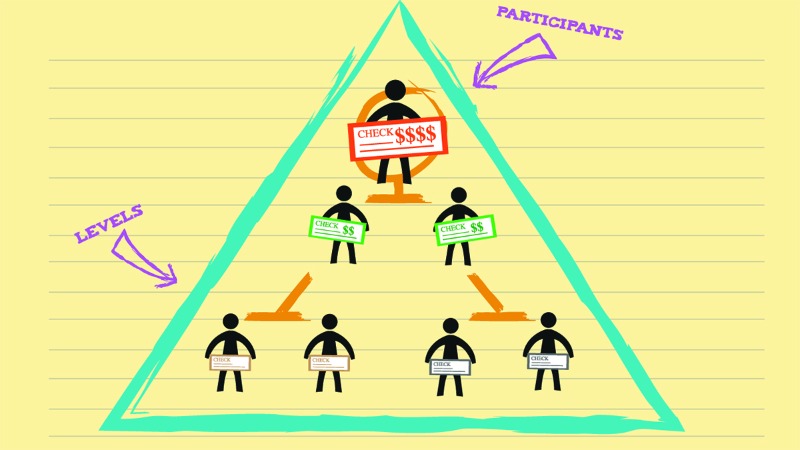

Pyramid schemes get their so-called name from the fact that they resemble a pyramid structure, starting with a single point at the top and gradually widening toward the bottom.

Now let’s make the following assumptions: The number “one” represents Founder “a,” who sits alone at the top of the heap. Assume “a” recruits ten second-tier persons to the level directly under him, and each recruit is required to pay a cash fee to enter. Not only do those buy-in expenses go straight to a’s wallet, but each of the ten new recruits must also recruit ten tier-three members, who must also then pay money to the tier-two individuals, who must then send a percentage of their earnings back up to the founder.

According to the hard-sell presentations made at recruitment events, those bold enough to jump into the pyramid will theoretically earn a lot of money from the recruits below them. However, in practice, the pool of possible members tends to dwindle over time. When a pyramid scheme fails, the top operatives walk away with a large sum of money, while the majority of the lower-level members are left with nothing.

The vast majority of pyramid schemes do not include the selling of genuine products or services with any inherent value, as they rely mainly on fees from new recruits. The same approach is disguised as a legitimate direct sales opportunity in a product-based pyramid scheme. The following is how it works:

A distributor hires ten salespeople, each of whom pays $500 for a product starter kit to sell.

Each starter kit sold earns the distributor a ten percent commission. The distributor also receives 10% of any product sold by any of his recruits, including additional beginner kits.

The recruits are told that the easiest way to generate money is to recruit other people to buy beginning kits rather than selling things. Everyone in their downline, the many tiers of recruits below them on the pyramid, pays commissions to the people at the top of the pyramid. In a pyramid system, it is literally impossible for everyone to profit.

To recuperate the cost of their original cost, the eighth level of the pyramid, for example, would need to recruit a billion people. The next stage would necessitate a population of 10 billion people, about double that of the Earth.

Pyramid scams don’t work unless someone loses money. Those at the end of the pyramid are pretty much-taken advantage of by those at the top. It’s a mathematical assurance that no matter how many people sign up for a pyramid scam, 88 percent will end up on the bottom level and lose their money.

If your money was stolen from a pyramid scam then contact us to help you get your money back!

Ways To Stay 100% Safe from a Ponzi Scheme

Know All About the Most Common Pyramid Schemes of All Time

Remember that not all MLMs or pyramid schemes are frauds. Some of the enterprises on the list below, for example, are legitimate businesses with a loyal following that continues to develop. However, before you sign up, join, or take a job with any of these companies, make sure you do your research to see if it’s a suitable fit for you and your lifestyle.

Many of these businesses promise you endless earning potential and reward you for recruiting new members. As a result, if you don’t trust the company or the product, selling it to your relatives and friends will be difficult.

United Sciences of America

United Sciences of America, founded in the 1980s, capitalised on the health risks of the time by promising to protect people who took their supplements from HIV and cancer.

William Shatner, a well-known actor, even endorsed them. NBC News, on the other hand, covered the company’s false claims and shady advertising. In addition, the company’s 16-member advisory board was compensated with consulting fees, and some received $100,000 research grants. Three states ordered the corporation to revise its claims in 1987, prompting high-profile advisory board members to resign and the company to disintegrate.

Hi-Tech Marketing for Fortune

Fortune Hi-Tech Marketing was labelled a pyramid scheme by the Federal Trade Commission in 2013, and it recruited people to sell Dish Network, telephone carriers, Front point Home Security, and health and beauty items. Salespeople, on the other hand, made more money from recruiting than from selling. Approximately 100,000 Americans were affected, with annual costs ranging from $100 to $300, plus others who paid extra for sales commissions and recruiting bonuses.

Amway

The FTC ruled in 1979 that Amway was not a pyramid scheme since distributors were only given a commission on the results new distributors purchased, not for recruiting new salespeople. This was a major cause for the FTC since it established the standard for establishing what constitutes a pyramid scheme and what constitutes a genuine MLM organisation. The FTC did, however, compel the corporation to make certain modifications.

Amway recently settled a $100 million class-action lawsuit brought in federal district court in California, requiring the firm to make even more modifications to its business model. The Commission of Federal Trade has come to a conclusion that the company’s distributors are selling the products to actual customers, not merely other recruits.

Do you suspect that someone had scammed you?

If you have any suspicion of a scam or phishing attack, then you can rely on EZChargeback to help you with protection, mitigation, and fund recovery.

You will feel safe knowing that experts with years of experience will be guiding you!

Be Aware of These Pyramid Schemes - Awareness is Essential

Many businesses have found success with so-called “multi-level marketing” techniques in recent years. It’s crucial to understand the distinctions between a pyramid scam and a real multi-level marketing firm. To begin, it is important to realise that pyramid schemes usually fail, although multi-level marketing organisations may succeed.

The most straightforward strategy to prevent being duped is to avoid any marketing that appears to be a pyramid scam. Here is some more advice to help you avoid pyramid schemes:

- Gather all relevant information about the business, its officers, and its products or services. Obtain written copies of the company’s marketing strategy, sales brochures, contracts, and other important documents. Avoid promoters who do not properly and thoroughly explain their plans. Examine the firm’s brochure or other written materials in particular. (A brochure is a legal document that contains information about a firm to potential investors.) If you don’t understand something, have someone outside the firm explain it to you.

- Determine if there is a market for the product or service. Is there a comparable product or service available? If that’s the case, how well does it sell? Stay away if the promoters appear to make the majority of their money by selling distributorships or significant start-up inventories to new recruits.

- Inquire if becoming a distributor necessitates the purchase of a product. Find out if the corporation will acquire your unsold inventory; otherwise, you may be stuck with them. Companies that are legitimate will buy back products for at least 80% to 90% of what you paid for them. Obtain written confirmation of all promises.

- If the start-up costs are high, be cautious. To become a “distributor,” some pyramid scams require you to pay a huge sum of money. What exactly do you get for your trading? Be wary of promises of rapid, easy, and exorbitant earnings.

- If the distributorship is giving a product to be used in the production of a final product, make sure it gets to the ultimate maker. If possible, contact the manufacturer and get a list of its clients. Customers should be contacted and asked if they are pleased with the goods.

- If the people selling you the program are friends or members of your religious or social group, resist the need to invest. They may have been duped into thinking they might make a lot of money in a short period of time.

- Examine any potential opportunities with the appropriate agencies.

Look For These Red Flags - Avoid a Pyramid Scheme Before It Happens

- Easy money or passive income are two terms that can be used interchangeably. There is nothing in this world as a free meal. You may be involved in an illegal pyramid scheme if you are offered money in exchange for doing little labor, such as making payments, recruiting people, or placing online adverts on obscure websites.

- There has been no evidence of retail sales-generating revenue. Request papers, such as financial accounts audited by a certified public accountant (CPA), demonstrating that the company makes revenue from outside the program by selling its products or services. In general, respectable MLM organizations make money by selling things rather than by recruiting new members.

- The commission structure is complicated. Unless your commissions are based on things or services that you or your recruiters sell to individuals outside the organization, you shouldn’t be concerned.

- The emphasis is on recruitment. A pyramid scam is one that relies primarily on recruiting people to join the program for a charge. If you get paid more for recruiting others than for selling products, be wary.

- There aren’t any actual goods or service offered for sale. If what’s being sold as part of the firm is difficult to assess, such as so-called “tech” services or products like mass-licensed e-books or internet ads on little-used websites, proceed with care. To make it more difficult to show that a company is a phoney pyramid scheme, some fraudsters pick fancy-sounding “products.”

Key Takeaways!

A pyramid scam occurs when fraudsters attempt to gain money purely by recruiting new members into a program, and there is only one mathematical outcome — collapse. Consider the scenario in which one person is tasked with locating six additional participants, each of whom is tasked with locating six new recruits. To keep the plan going, you’d need more volunteers than the whole population of the United States in only 11 tiers of the “downline.” Many countries make pyramid schemes illegal. The network effect profit model frequently traps people into recruiting their friends, which can be unpleasant for all parties involved and damage relationships. Such schemes are best avoided by investors.

Earn $5,000 per month working from home!” I’ve seen signs like these all-around towns and have always wondered what type of con is going on. I got an excellent idea after reading this article on pyramid scams. Because they prey on our need for quick, easy money, pyramid scams are so popular. However, the odds are so stacked against you in this fraud that it’s practically mathematically impossible to make any money at all. In cases like this, it’s wise to follow some sound advice: if something appears to be too good to be real, it probably might be.

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you