Need Consultation for Recovering Funds From an Investment Scam? Let Us Help You!

Excerpt: Scams are all over the Internet, which is a sad fact. It’s becoming increasingly difficult to tell whether you’re getting accurate information or being fed bogus news

Introduction

A scam is a strategy to swindle someone out of something valuable, usually money or personal information.

Scam, fraud, rip-off, racketeering, hustle, and sting are some of the other terms for it. It is a type of thievery. Financial products and services such as shares, bonds, managed funds, derivatives, foreign currency, and cryptocurrencies, as well as investing or trading through an online or app-based trading platform, are targeted by investment scams. Scammers might operate individually or in groups. They can target clubs and churches, as well as people, such as senior folks. They could even be folks you know and trust in your neighborhood.

Scammers routinely exploit technology and the media to deceive people. They may use social media to promote or use messaging applications to make payments. They may have respectable websites with real business names and contact information. They may fake documents or even impersonate government officials over the phone or over e-maile-mail. Investment scams and other get-rich-quick schemes are becoming an increasingly major part of the online criminals’ cake, preying on one of the most basic human weaknesses.

Although the number of victims is currently lower than that of fraudulent purchases, identity theft, and dating fraud, the cost of investment fraud accounts for over half of all online fraud losses.

Investing in cryptocurrencies entails accepting risks, but one of them should not be getting duped. According to reports, scammers are capitalizing on the Bitcoin craze by luring individuals into phony investment opportunities in unprecedented numbers. Since October 2020, the number of claims has increased dramatically, with about 7,000 persons reporting losses totaling more than $80 million. Their claimed loss was $1,900 on average. In contrary to the same time around last year, there were roughly twelve times as many reports and about 1,000 percent greater reported losses.

Latest News & Scam Alerts

The Latest 411 on Current Day Cell Phone Scam

Smishing: A Whole New Level of Scams & Frauds

7-10% of the U.S. population are victims of Online Scam each year, and 21% of those experience multiple incidents of Internet Scam/Fraud.

CNBC News

If you’re someone who wants to protect your financial data, then you’re definitely at the right place. We can give you the best practices in identifying red flags as well as help you in recovering your stolen money from scammers!

Table of Contents

CHAPTER 1: Encountered An Investment Scam - Follow These Steps Instantly!

Nowadays investment scams are becoming the talk of the town, and innocent victims of such scams are trying to figure out what to do in case they do get scammed.

Well, it is a complex process, but one we should all follow. If you have been scammed, the first phase is to make sure that YES! you have been scammed, then contact relevant authorities, and take actionable steps from there.

Have You Actually Been Scammed or Could it Be Something Else?

To identify whether or not you have actually been scammed and your investment is under attack, look at the following cues –

They provide you with little or no written information

Trustworthy investments should come with written paperwork that explains the investment in plain English and include any pertinent details. In general, financial product offers (such as shares) have precise requirements about what must be communicated to investors in order to ensure that they receive correct and non-misleading information.

They demand unique remuneration

Scammers despite ‘regular’ banks. They’re probably not authentic if they want you to pay with wire transfers or credit cards, or by cryptocurrencies like Bitcoin, or into an overseas bank account with a different name than their firm, such as a personal account.

Fake dreams all around

They say you’ve already made a profit despite the fact that you haven’t paid them anything. This is a ruse to get you to pay an “initial deposit.”

Legitimate companies don't allow you to invest in credit

They may inform you that the sale can only take place if you purchase more of the investment or that taxes or fees must be paid.

Unable or unwilling to repay you when you ask

Financial products such as stocks, foreign exchange, and derivatives can normally be sold within hours or days of purchase. That fast, you should be able to get some or all of your money back. Shares that no one wants are an exception.

They're on the FMA's Warning List of known scams

Investments marketed outside licensed markets may take longer to sell, but you should only deal in those investments through licensed firms. However, keep in mind that fraudsters frequently alter their names, so just because they aren’t on our list doesn’t imply they aren’t a hoax.

Phase 2 - What To Do Next!

If you are noticing something like this then chances are that you are getting scammed, you must…

Take a minute and ask yourself

“Is this for real?” Read over the warning signals above and, if any of them apply to your scenario, make a list of your own reasons why it could be a scam.

Trust no one!

Don’t think something is safe just because a family member, friend, coworker, church leader, or other trustworthy contact recommends it; they could be scam victims or perpetrators as well.

Don’t get fooled

Don’t be fooled into thinking a business is legitimate just because it advertises on a reputable website or social media platform, and be wary of ‘celebrity endorsements.’

Get feedback from relatives and friends

See what a friend who is good with money has to say about your suspicions. Others may be able to assist you in ‘waking up to the truth of a fraud.

Contact authorities

Talk to your local Citizens Advice Bureau or a budgeting assistance program. They can frequently provide free guidance.

Collect evidence

Take note of any inconsistencies in their bank account information. It could be a scam if they claim to be in one country but have a bank account in another.

Verify the registration information on the website

To find out who registered it and then use a “who is” online tool. Be wary if it wasn’t in the country where the company claims to be situated and/or was only recently established while they claim to have been in business for years.

Perform a reverse image search on their website

Tineye.com, for example, lets you copy and paste photographs into their search engine and see where else they’ve been used.

• Request a copy of the investment’s Public Disclosure Statement (PDS). Almost all authorized investments must be accompanied by a disclosure document.

Start Taking Decisive Action

After phase 2, start taking actionable and decisive steps which work towards getting your money back from scammers.

- Request that they communicate via e-maile-mail. Get everything they say in writing, and ask for descriptions of your current assets so you can start a paper trail.

- Stop sending money to them: Even if they say it will help you get your money back, don’t make any more payments. All of this is part of the con.

- Request a refund of all or part of your money. Assume you require it immediately. Most financial market investments can be sold almost immediately, if not within days. It’s probably a fraud if they can’t or won’t trade yours that soon or if they insist on charging you more to get it back.

- Disconnect from the scammer. If they call, ignore them. If they send you an e-mail or a letter, ignore it. If you keep in touch, they’ll try to extort additional money or information from you.

- Contact your bank right away. They will have a fraud policy in place. If you send money through another bank or transfer service, you should contact that service.

- Contact chargebacking: they can provide advice or help you get your investment back.

- Inform family and friends about the situation. It’s difficult to confess you’ve been duped and lost money, but fraudsters thrive on this humiliation and secrecy since it allows them to continue defrauding others.

- Victim Support can be reached on their website. They can offer free emotional and practical assistance as well as information.

If a relative or friend is being scammed…

Inform them that you believe it is a ruse. Scam victims often don’t recognize what’s going on until it’s too late and they’ve lost all of their money, or they refuse to admit they’ve been duped.

- Encourage them to go to the FMA website. Some victims have no idea what a scam is or cannot believe that con artists are that skilled at deceiving people. Request that they study the warning flags of a scam described above and conduct some online research. If necessary, assist them in doing so.

Do you suspect that someone had scammed you?

If you have any suspicion of a scam or phishing attack, then you can rely on EZChargeback to help you with protection, mitigation, and fund recovery.

You will feel safe knowing that experts with years of experience will be guiding you!

CHAPTER 2: Companies That Recover Funds Provide Legal Protection, So Turn To Them

Have you ever been concerned that funds recovery firms aren’t legitimate? A number of regulations now govern the asset collection industry, and educated clients will not hesitate to sue in court if their rights are infringed.

Asset recovery firms are fully aware of this, which is why they are knowledgeable about the law. Third-party collection firms are familiar with both federal collection constraints and the laws of the states in which they are governed. Allowing a fraud collection company to recover payments on your behalf removes the legal hazards of trying to recover funds on your own.

Your Scammers Will Be Exposed

Conversations between scammers and collection agencies are recorded. If you try to prosecute a fraudster in the future, the fund recovery agency will keep detailed records and pieces of evidence of all attempts to contact the scammer. This documentation shows the court that you went to great measures to reclaim the money you were cheated out of.

Increased Productivity and Speed

Traditional paper-based processes are inefficient, prone to human error, and frequently require the involvement of a third party. By optimizing these processes, transactions can be completed faster and more efficiently. The blockchain may store both documentation and transaction data, eliminating the need for paper trade.

They Are Professionals

Fund recovery companies, like the businesses that defrauded you, are great manipulators. When dealing with scammers, you may feel alone, but funds recovery companies can help you navigate the process. They understand the legality of it all and which frauds require which types of attention. Overall, funds recovery businesses will recover your funds, which should be your first worry after being duped.

Guaranteed Money Back

You don’t have to worry about getting your money back since you will be working with professionals in the industry. You’ll also be spending money upfront to fund recovery agencies, so you’ll want to get the most bang for your buck. You’ll almost certainly succeed with the companies that The Ez Chargeback recommends to you!

Psychological Ease

When you’re duped, you’re embarrassed to tell anyone. However, studies show that confiding in a person or even a company representative might improve you mentally over time. The Ez Chargeback will not only listen, but they will also help and act. Keeping it inside will only lead to bad psychological effects such as despair, anxiety, and fury. Contact the Ez Chargeback right away to report your case.

Hiring a Third Party Allows You To Save Time

One factor is money outlays, but what about the time and effort required to effectively investigate scams? Even at the most basic level, scam recovery may be a major drain on an organization’s time and resources.

It’s an inconvenient and unnecessary distraction. As a result, the essential benefit of hiring professionals is the speed and ease with which the recovery can be performed. All while allowing you to pay attention to what matters most: running your business. Professional fraud recovery services aren’t always free, but they can still save you money.

Once again, you must consider whether DIY asset recovery is a big waste of time and resources. Furthermore, there are no guarantees that the DIY method would yield a satisfactory result. The bigger the scam and the more urgent the issue, the more money you can save by hiring help.

Legal Representation

The asset collection sector is now supervised by a slew of regulations, and knowledgeable clients will not hesitate to sue if their rights are violated. Asset recovery companies are aware of this, which is why they are well-versed in the law. Both federal collection restrictions and the laws of the state in which they are licensed are well-known to third-party collection firms. Allowing a fraud collection business to recover payments on your behalf eliminates the legal risks of recovering monies on your own.

CHAPTER 3: Need Recovery Consultancy for A Specific Investment Scam?

Scenario 1 - Promissory Notes

A promissory note is a debt obligation that contains a written promise by one entity (the note’s originator or maker) to pay another party (the note’s payee) a certain sum of money, either immediately or later.

A promissory note normally contains all of the debt’s data, such as the principal amount, interest rate, maturity date, issuance date and place, and the issuer’s signature. Although they can be issued by financial institutions—for example, you can be requested to sign a promissory note in order to get a small personal loan—promissory notes are most commonly used to allow businesses and individuals to acquire finance from sources other than banks. This source can be an individual or a business prepared to carry the note (and supply the funding) on the agreed-upon terms. Promissory notes, in effect, allow anyone to be a lender.

Promissory notes are frequently sold by independent life insurance agents who are enticed by hefty commissions of up to 30% and may have little knowledge of the investments beyond what marketers tell them. (In some circumstances, insurance agents have bought promissory note investments themselves.) The insurance agents may wrongly believe that the notes are not securities, and they may also be unaware that in order to offer securities in Connecticut, they must be licensed as brokers by the Department of Banking.

Some notes are issued on behalf of non-existent companies. Promissory note certificates with legal-sounding text and gold embossed seals are frequently given to investors. Because the notes are allegedly bonded or guaranteed by insurance firms, insurance agents may mislead investors that they are a secure investment. However, the majority of the assurance firms backing the notes are unlicensed, based abroad, and unable to financially back up their promises. As an added risk, organizations that use this type of financing sometimes struggle to pay investors their promised returns within the prescribed short timeframes.

Potential investors may be caught off guard since they are familiar with the insurance agents marketing the notes and may have a long-standing, trusted connection with them. Promissory notes are also sold by out-of-state financial advisers, and some are advertised on the Internet.

What makes promissory notes so appealing? Many of the scammed people are senior citizens who do not want to be exposed to the risks of the stock market and are not interested in standard insurance products. They might be drawn to “promissory notes” because they appear to provide both safety and a higher-than-market rate of return. The promissory notes, according to the sales pitch, are from “well-established” enterprises in need of financing to expand their operations. Instead of borrowing money from a regular lender, they give investors the opportunity to buy such “notes,” which typically have a nine-month maturity and a 20 percent annual interest rate. Clients may be urged to “cash in” their life insurance policies and “roll” them into these notes by their agents.

What happens to the money? The promoters may pay agents commissions with a portion of the money obtained from investors, or they may employ a “Ponzi scheme” to pay Peter with new money raised from Paul. Typically, regulators claim they take the rest and spend it on personal bills or high-flying lifestyles.

DO YOU NEED EXPERT ADVICE?

We have encountered victims who were mentally and emotionally drained when they were scammed out of their money.

We can help you with your legal and technical concerns and we can help you get your money back.

Tips To Avoid Promissory Note Scams

Here’s how you can avoid becoming the victim of a promissory note scam:

Examine the salesperson

Insurance agents and others who sell “promissory notes” must have the right securities license. To see if the person is registered, call the Securities Division at 860-240-8230 or go to the Department’s website.

Take a look at the investment

Conduct research to establish whether the company selling promissory notes is reputable and capable of paying its debts. Securities are the most common types of promissory notes provided in frauds.

Before handing over any cash, check with the Securities Division to see if the notes are properly registered or exempt from registration.

Be aware of investments that are promised

Promissory notes that are allegedly “insured” or “guaranteed” should be avoided, especially if a foreign insurance provider is involved. Find out if the foreign insurance company may legally conduct business in the United States by contacting the Connecticut Department of Insurance.

Investing in "risk-free, high-yield" opportunities should be avoided

As a general rule in finance, the greater the profit, the greater the risk. Con artists frequently utilize promises of “risk-free, high returns” that are higher than the current market to entice their victims. Always remember that if anything appears to be too good to be true, it most likely is.

If You're a Victim, Here's What You Should Do…

A promissory note is a type of loan instrument that expresses the issuer’s written promise to repay another party. A promissory note will feature the two parties’ agreed-upon terms, such as the maturity date, principal, interest, and the signature of the issuer. A promissory note, in essence, permits entities other than financial institutions to provide lending mechanisms to other businesses.

Act quickly if you feel you’ve fallen victim to a promissory note fraud. For assistance, contact the Department of Banking.

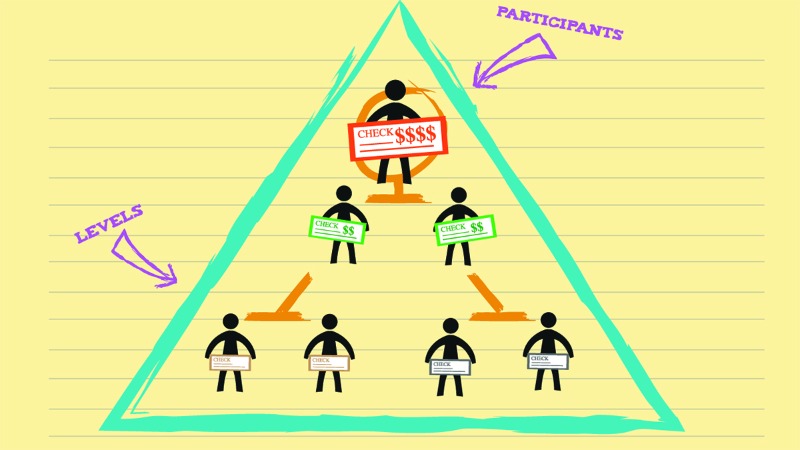

Scenario 2 - Ponzi Pyramid Schemes

A Ponzi scheme is a deceptive financial strategy that promises individuals large returns with little risk. A Ponzi is an investment scam in which money is gathered from subsequent investors in order to pay off prior investors. This is comparable to a pyramid scam in that both rely on new investors’ money to pay back previous investors.

When the influx of new investors stops, and there isn’t enough money to go around, both Ponzi and pyramid schemes inevitably collapse. The schemes start to fall apart at this point.

Ponzi Schemes: An Overview

A Ponzi scheme is a kind of investment scam in which customers are promised a high profit with little or no risk. Companies that engage in a Ponzi scheme devote all of their resources to acquiring new investors.

This additional revenue is used to pay original investors their returns, which are labeled as a genuine profit. Ponzi schemes rely on a steady stream of new investments to keep paying out profits to existing investors. The scheme falls apart when this flow runs out.

Red Flags of a Ponzi Scheme

The Ponzi scheme concept did not die in 1920. The Ponzi scam evolved alongside technological advancements. Bernard Madoff was convicted in 2008 of running a Ponzi scheme in which he fabricated trading reports to indicate a client was profiting from assets that didn’t exist. On April 14, 2021, Madoff died in prison.

Regardless of the technology employed, most Ponzi schemes include the following characteristics:

- An assurance of large returns with minimal risk.

- A steady stream of profits regardless of market conditions

- Securities and Exchange Commission-unregistered investments (SEC)

- Investment methods that are classified as “secret” or “too complicated to reveal.”

- Clients are not permitted to access formal investment papers.

- Clients that are having trouble withdrawing their funds

Scenario 3 - Real Estate Investment Fraud

Investment con artists entice you in by promising to teach you how to make a lot of money fast, simply, and safely – usually by investing in the financial or real estate markets.

Scammers may start with a free lecture and then charge you a large fee for their “proven” investment strategies. But it’s the lies they tell you that is the true trickery.

Scams in Investment Coaching

Scammers will claim that their “patented,” “tried,” or “proven” approach (or something similar) would educate you on how to make money by investing in bonds, stocks of a company, foreign currency, or tax liens. They claim that their financial strategy will prepare you for life – and even allow you to retire.

What to Be Aware Of

They pique your interest with infomercials or internet advertisements that encourage you to attend free events or view free introduction films. However, you soon discover that you must pay a high sum to receive the guidance they promise.

They’ll show you examples of folks who have benefited from their coaching services. However, you have no means of knowing whether or not their stories are accurate. The truth is that investing coaching scam promoters overestimate the amount of money you can make with their approach. They also fail to provide the step-by-step instructions they claim and lie about the success of others. It’s all part of an advertising ploy to dupe you into paying hundreds of dollars for bogus promises.

HAVE YOU BEEN SCAMMED AND NEED HELP IN FIGHTING BACK?

Scammers can create complex scams that can trap even the most cautious of people. But it’s not too late because we can help you track the damage done by scammers.

We can help you get your money back!

Scams in Real Estate Investment Seminars

Seminars on how to invest in real estate, both in-person and online, frequently promise “risk-free” training or business coaching solutions. They could entice you in with grandiose promises or assurances of financial freedom, promising to show you how to make a lot of cash. Many real estate investment workshops, however, are frauds.

Real estate investment seminar promotional materials and sales pitches frequently make outrageous claims:

- Scammers claim that regardless of your expertise or training, you may make a lot of money quickly. However, this is not the case.

- Scammers claim that their offer is a “sure thing” that will provide you with security for years. It won’t.

- Scammers claim that working part-time or from home will earn you a lot of money. Most people, however, do not.

- Scammers guarantee you’ll be guided every step of the way to success. However, there is frequently minimal coaching and no success.

- Scammers say that the scheme was successful for other people, including the organizers. It may have done so for a few people, but the majority of people never recover their investment.

Don’t be fooled by advertisements boasting about how much money people gained with little time, effort, or danger. Or advertisements with celebs endorsing the program. Such assertions are untrustworthy and do not imply that the program is effective. Fake testimonials and paid endorsements are frequently used in real estate investment scams.

The pay-off for most consumers who attend these real estate investment seminars — some of which cost thousands of dollars to attend — falls short of the promises made. In fact, the majority of people never see their money again.

How to Stay Away from Investment Scams

If you’re thinking about paying for a program that promises to help you invest your money, think about the following:

- It is possible to fabricate statistics and testimonies. Scammers want you to assume that their scheme is always effective. They may provide testimonials or reviews from people who have utilized their program and made a lot of money. However, those could be paid extras or fake reviews. You don’t have any method of verifying their claims.

- The importance of current events is exaggerated by con artists. Scammers use current events and headlines to make their investment opportunities appear fresh, novel, and timely. They want you to feel hurried into making a decision without thoroughly researching the offer.

- No one can promise a certain rate of return on investment. Scammers may say you can earn thousands of dollars each day or month for the rest of your life. However, they do not inform you of the dangers. No one can guarantee the success of a business venture. If you ask them specific questions about the investment, they may offer you imprecise responses or simply focus on how much money you’ll allegedly make.

Scenario 4 - Predatory Lending

Predatory lending is when borrowers are subjected to unfair, fraudulent, or abusive loan terms. These loans frequently have excessive fees and interest rates, deplete the borrower’s equity or place a creditworthy borrower in a lesser credit-rated (and more expensive) loan, all to the lender’s profit.

Predatory lenders frequently employ aggressive sales tactics and take advantage of borrowers’ lack of financial knowledge. They persuade, induce, and aid a borrower to take out a loan that they will not reasonably be able to repay by dishonest or fraudulent conduct and a lack of transparency.

The Process of Predatory Lending

Predatory lending refers to any unethical activities used by lenders to attract, encourage, mislead, and aid borrowers into taking out loans that they cannot afford to repay or must repay at a rate that is significantly higher than the market rate. Predatory lenders take advantage of borrowers’ situations or ignorance.

A loan shark, for example, is the prototypical predatory lender—someone who lends money at an exorbitant interest rate and may even make threats to collect debts. However, more societal institutions such as financial institutions, financial firms, mortgage brokers, attorneys, and real estate contractors engage in a significant amount of predatory lending.

Many borrowers are put in danger by predatory lending. People with low credit ratings, the less educated, or those who are exposed to discriminatory lending policies based on race or ethnicity are typical targets. Predatory lenders frequently target areas where there are few other loan options, making it harder for customers to shop around. They entice customers with aggressive sales tactics via mail, phone, television, radio, and even door-to-door sales, and they profit from a range of unethical and fraudulent practices.

Keep an Eye Out For These Tactics…

Predatory lending is intended to benefit the lender first and foremost. It disregards or makes it difficult for a borrower to repay a loan. Lending practices are frequently dishonest, attempting to exploit a borrower’s lack of understanding of financial concepts and loan restrictions.

The Federal Deposit Insurance Corporation (FDIC) has recognized several of these strategies, as well as others:

- Excessive and abusive fees: These are frequently hidden or minimized because they are not included in a loan’s interest rate. Fees of more than 5% of the loan amount are not uncommon, according to the FDIC. Another example is excessive prepayment penalties.

- Balloon payment: At the end of a loan’s term, a predatory lender will make one huge payment to make your monthly payment appear low. The issue is that you may not be able to afford the balloon payment, forcing you to refinance, incur further fees, or default.

- Loan flipping: When a lender forces a borrower to refinance many times, the lender earns fees and points each time. As a result, a borrower may find themselves imprisoned by mounting debt.

- Asset-based lending and equity stripping: A lender gives you a loan based on your asset, such as your home or car, rather than your ability to repay it. You risk losing your home or car if you fall behind on your payments. Equity-rich, cash-strapped elderly persons on fixed incomes may be targeted for loans that they will struggle to repay, jeopardizing their home equity.

- Unnecessary add-on products or services, such as mortgage life insurance with a single premium.

- Steering: Borrowers are steered towards pricey subprime loans despite the fact that their credit histories and other variables qualify them for prime loans.

- Reverse redlining: The Fair Housing Act of 1968 abolished redlining, a racist housing policy that effectively prevented Black families from obtaining mortgages. However, residents of redlined areas are overwhelmingly Black and Latino. Predatory and subprime lenders frequently target them in the form of reverse redlining.

Scenario 5 - Social Media / Internet Investment Fraud

Many investors rely on the Internet and social media to make investing decisions. While these online tools might be beneficial to investors, they can also be enticing targets for crooks.

Criminals are notorious for quickly adapting to new technology, and the Internet is no different. The Internet is a cost-effective and time-efficient tool to reach a large audience. With little effort, a website, online message, or social media site can reach a significant number of people. It’s simple for con artists to make their messages appear genuine and convincing, and it can be difficult for investors to distinguish between fact and fiction.

If an investment campaign piques your attention, do your homework before giving them your phone number and email address. You could be putting yourself up for investment fraud if you don’t. Being an educated investor is the key to avoiding investment fraud on social networking platforms or elsewhere on the Internet.

The Internet

Facebook, YouTube, Twitter, and LinkedIn have all become important tools for American investors. Investors use social media to get research on specific stocks, background information on a broker-dealer or investment adviser, counsel on an overall investing plan, up-to-date news, or simply to talk about the markets with others.

There are a number of aspects of social media that thieves may find appealing. Fraudsters can utilize social media to appear legitimate, hide behind anonymity, and reach a large number of individuals at a little cost.

Be Wary of Unsolicited Investment Offers

Investment fraudsters use social media platforms, chat forums, and bulletin boards to find victims. Proceed with caution if you see a new post on your wall, a tweet that mentions you, a text, an email, or indeed any unsolicited – meaning you didn’t even ask for it and don’t know the sender – communication about an allegedly lucrative investment opportunity.

Unsolicited sales pitches could be part of a phony investment scheme. To reach potential victims, several frauds use spam. Spammers, for example, can send individualized messages to millions of people at once using a bulk e-maile-mail program for a fraction of the expense of cold phoning or traditional mail. If you receive an anonymous message from someone you don’t know offering a “can’t miss” investment, your best bet is to ignore it and report it to the Securities and Exchange Commission’s Complaint Center.

Scenario 6 - Affinity Group Fraud

Affinity fraud is a sort of investment fraud in which a con artist targets members of a specific group based on characteristics like race, age, religion, and so on.

The fraudster is either a member of the group or claims to be one. A Ponzi or pyramid scheme is frequently promoted by the con artist.

Affinity Fraud: An Overview

Affinity fraud takes advantage of and abuses the group’s inherent trust. A fraudster may, for example, target a particular religious congregation.

Often, the person will try to enlist the assistance of the group’s leader in marketing the investment program. In this case, the leader unwittingly becomes a pawn in the fraudulent plot. Victims frequently fail to contact authorities or pursue legal remedies, preferring instead to hash things out amongst themselves, especially when fraudsters have influenced respected community or religious leaders to persuade others to contribute.

Fraudulent Affinity Most Common in the United States

The problem is widespread, but it is best documented in the United States. Marquet International Inc. conducted a Ponzi scheme study in 2011 that looked at 329 big U.S. investment fraud cases with losses of at least $1 million and a total claimed loss of approximately $50 billion.

The elderly or retired, religious groups, and ethnic groups were the most popular affinity groups targeted by Ponzi schemers. In their investigation, these three target groups accounted for 85 percent of all affinity group cases. Because so many of the state’s people are members of the LDS Church, according to The Economist, Utah has the highest rate of affinity fraud per capita in the country.

Members of the LDS community have a strong tendency to trust individuals who claim to be members of the church leadership or who present themselves as such, making them particularly vulnerable to this type of deception. Affinity scams cost Utah residents an estimated $1.4 billion in 2010. Affinity fraud is particularly common in Utah County, particularly between Alpine and Provo.

Scenario 7- Annuities

Annuities are products that provide a steady stream of income. They can provide tax benefits, payment intervals adapted to your needs, protection against losing your initial investment, and the ability to transfer money to your beneficiaries.

Annuities are commonly used by consumers to ensure lifetime income and help fund retirement. Annuities can be tailored to provide income or long-term growth, but they are not suitable for short-term investment. People who want long-term financial security, retirement income, diversification, and principal preservation may consider these items.

Consumers should be wary of profit-driven insurance companies and agents that promote unsuitable products to seniors and other investors.

Annuity Fraud: What Is It?

While annuities are secure and important financial instruments, the market may be complicated, and some take advantage of the general public’s ignorance. Anyone thinking about buying annuities should be aware of the risks of engaging with shady insurance salesmen. Despite the fact that the sector is regulated by a number of state and federal bodies, novice investors and seniors are still duped into buying unsuitable products or selling their annuities for inflated prices.

You may safeguard your assets and improve your retirement readiness by learning to spot potential scams, such as contracts that seem too good to be true and wind up losing you money in the long term.

Other Annuity Scamming Techniques

Annuity scams aren’t just for the elderly. In order to profit from clients’ anxieties, agents with rehearsed pitches may lie to younger clients and make them go through high-pressure appointments.

Agents trick investors into buying annuities that may not be fit for their financial circumstances by advertising contract signing bonuses and today-only discounts. They may also purposefully pitch contracts that are difficult to comprehend or omit to fully disclose maintenance and withdrawal fees. To appear trustworthy, salespeople have been known to take on phony titles or pretend to hold fake qualifications.

These pointers will help you find an annuity without jeopardizing your assets:

- Keep track of annual maintenance expenditures. You should select an annuity with modest annual expenses.

- Avoid agreeing to a premium bonus because you’ll almost always pay for it later with surrender fees.

- Be aware of the liquidity implications of holding an annuity, as withdrawals are subject to fines and IRS tax penalties.

- Consult a tax specialist, and don’t assume that tax delay equates to no taxes.

- Be advised that commissions on variable annuity sales will be greater (annuities tied to market fluctuations).

- When studying and signing policies, have a trusted friend, relative, or attorney present. • Stay away from annuities with surrender periods of more than seven years.

- Ensure that surrender fees are less than 14% of the principal.

- Don’t invest more than 35% of your assets in annuities.

Remember, as you get closer to retirement age, you’ll want to locate investment solutions that fit your assets, current needs, and long-term objectives. Annuities can add good value to a portfolio, but they aren’t right for everyone.

WORRIED THAT SOMEONE HAS YOUR PERSONAL & BUSINESS INFORMATION?

With how easy it is for scammers to acquire your data, it’s reasonable to be alarmed. Protect yourself and your loved ones by getting advice from experts.

We will guide and even help you get your money back from scammers.

CHAPTER 4: Top Recommended Investment Scam Recovery Companies

Chargebacking is a funds recovery investigation firm that attempts to provide you with the top consultants in the industry in order to recover your money from a scammer. They are aware that many people have been duped out of large quantities of money, and chargebacking is here to help you fight back. Experts in charge backing convene to evaluate, analyze, and probe details in order to track down and capture the corporation who cheated you – and they don’t stop there; they also recover the money you lost. Chargebacking is a well-known and respected fund recovery organization.

Chargebacking has been in operation for over 7 years, and they have recovered about $100,000 for its valued clients in the last few years. Over 800 clients are represented in the chargebacking portfolio, with not a single client losing a scamming case. When facing a scammer, the organization believes in a robust, no-nonsense approach to ensure that its clients’ money is returned in the most efficient and effective manner possible. No matter how complicated the case is, chargebacking will help you recover your assets.

When you think of investing scams, you might think of illegal deals or low-risk investments that promise enormous profits but turn out to be false and unreal. Offers of low- or no-risk opportunities, guaranteed profits, overly predictable returns, complex procedures, or unregistered protections are common investment frauds. There are also numerous sorts of investment or trading scams, such as CFD trading scams, forex scams, cryptocurrency scams, and many others.

These con artists typically seek to abuse innocent people; they do it by establishing confidence in order to commit fraud against them. The perpetrators range from experienced investment consultants to someone with whom you frequently interact, such as a neighbor, acquaintance, or family member. The fraudster’s ability to foster confidence is what makes these schemes so successful. Before trading or investing in a large possibility, financial supporters should always examine and obtain all available data and information. If you’ve had a similar experience, don’t panic; instead, partner up with Chargebacking recovery experts and fight fire with fire!

Chargebacking will locate your scammer, register a dispute against them, monitor the case, and ensure that your funds are restored. Trading and investing are tricky businesses; one must stay on top of the market and gain knowledge about it to guarantee that their investments, assets, and other critical information are in good hands. To be sure you’re working with genuine brokers, contact Chargebacking. If you suspect you’re being scammed, contact Chargebacking right away! When it comes to recovering assets stolen during trading or investing frauds, time is essential.

They are well aware that many people have been defrauded of big sums of money, and charge backing is here to assist you in fighting back. Their experts collaborate to research, evaluate, and explore details in order to track down and identify the fraudster – and they don’t stop there; they also assist you in reclaiming the funds you’ve lost. They are a well-known international funds recovery agency.

Chargebacking has been in business for almost seven years, and in the last few years, they have recovered over $100,000 for its loyal clients. There are over 800 clients in the portfolio, and none of them has ever lost a fraud action. When addressing a scammer, the company takes a firm, no-nonsense approach to ensure that their clients’ money is recovered as quickly as feasible. Regardless of how hard the issue is, they will aid you in recovering your assets.

Specialists & Professionals From Across The Board

Charge backing includes specialists and professionals on board who ensure that the activity is managed efficiently and with the client’s worries and priorities in mind. Each of Chargebacking’s representatives has more than three years of experience in their respective industry, making them exceptional at what they do – not just because they love what they do, but also because their clients do it! Everyone you speak with at their company, from customer service to lawyers and forensic accountants, is clearly there to help you. From the initial assessment of the case to gathering proof and finally fighting the fraudster and retrieving your money, their team will be your constant ally throughout the entire procedure.

Chargebacking was not invented on the spur of the moment by the founder of the organization! Mr. Eddie Marckenson was misled into nearly losing $15,000 as a result of banking fraud, specifically a cheque scam.

The developer of Chargebacking wanted to pay his son’s university tuition fee with a check, but the check was intercepted and forwarded to his son at university in the wrong hands. Mr. Marckenson’s bank account had been emptied of $15,000 by a con artist who vanished. “Rather than brooding on what has been taken from you, get up, battle, and recover what is rightly yours,” Mr. Markenson’s son told his father after he discovered his tuition fee had been taken.

More Than 6 Years of Experience

Following that, he used his 6+ years of experience in the chargeback industry and risk management market to educate himself on the laws, rules, and regulations of filing disputes and claims against scammers, eventually recovering his money after a lot of hard work, follow-ups, and battles with financial bodies.

That’s when Mr.Marckenson saw a gap in the market: not everyone has the time or means to fight fraud claims, so why not assist folks by preparing and defending their cases for them? In the realm of investments, forex is the wild west of traditional monetary tools. Nonetheless, major financial organizations such as banks account for a sizable portion of the membership, which aids businesses in managing cross-currency rates when financing or purchasing items. It is, nevertheless, by far the most transparent and low-cost venture that anyone may undertake. A broker may want a $5,000 minimum deposit, although many forex firms only require $1 to begin. Day trading equities in the United States require a total investment of $25,000; forex does not.

It is the most engaging business sector due to its quick access to critical influence and availability 24/7. However, this draws a large number of troublemakers, or scammers, as we call them. Few governments have complete control over the FX markets, but none are as consistent as the United States. Many countries have few laws and allow anyone to establish a money market fund within their borders. Due to the high number of scammers and fraudsters on the market, it’s recommended to stick with dealers situated in the United States, the European Union, or the United Kingdom.

No Fraudster is Safe From The Chargebacking Team!

Con artists in the forex market are continuously coming up with new and inventive ways to scam unwary victims. Even as you sleep, these con artists improve their system’s ability to conduct tailored trades that bring great benefits. The term “robot” has been coined to describe the ability to work naturally. Regardless, a major number of these structures have been attempted by a free source and have not been subjected to a typical inspection.

Brokers rarely address scammers in the forex business. Individual players who appear as agency groups despite the fact that they are not yet formed are the most common. They are often well-versed in hacking tactics and can fabricate data on the website they built. Owners of such bogus websites lack a permit and are thus not properly regulated. They, too, do not always have a fundamental knowledge of the Forex market! However, to a novice investor who has not been taught the financial aspects of money, not everything is obvious. For example, a visitor to a well-designed website would notice contagious promises of benefit, as well as phrases or idioms like “spread” and “moment fulfillment of instructions.” For the uninitiated, this may give the untrustworthy site an air of legitimacy. Individuals then sign up, set aside a payment – and here comes the fascinating part – and sophisticated technology is utilized to manipulate them.

CHAPTER 5: The Funds Recovery Process for Investment Scams

Are you aware that numerous recovery firms can help you recover monies that have been lost due to an internet scam or fraud? If you’ve been scammed through an internet fraud that has taken your money, you’re not alone.

Millions of individuals are misled every year all around the world just because they want to get rich, improve their family’s financial status, and live the lives they’ve always imagined. People fall prey to frauds and scams in trying to achieve all of this, resulting in huge financial loss. However, only a few years ago, things were drastically different. You were unable to obtain assistance from any company in retrieving your payments.

It’s critical to recognize that internet fraud and funds recovery serve to fill a largely untapped market niche. You now have the opportunity to regain control of your situation and create the best possible outcome by recovering your funds. Fund recovery experts can assist you in reclaiming the funds you’ve misplaced. Because time is of importance in such frauds, they act quickly and consistently, and maintain complete openness and keep our consumers informed throughout the process for their benefit.

We’ll take you through the steps to get your money back while keeping the same concept in mind.

Make a Request

Do you suspect your broker, an internet business, or someone stealing from your digital wallet has defrauded you? To get your stolen dollars back, the first step is to denounce the scam. Submit a request to our team explaining the circumstances surrounding the fraud you were a victim of. Following that, our team of professionals will do a preliminary examination of your case and direct you towards an efficient and effective recovery firm.

Check Your Request

Assume you’ve been the victim of a dating scam online. The investigation specialists will begin reviewing and working on your case as soon as you figure it out and alert us via the website’s online contact form.

Asset recovery firms for investment scams recognize that internet fraud is a time-sensitive issue, so the sooner they begin investigating it, the sooner your funds can be returned. According to research, the scammer is caught 87 percent of the time if the fraud is reported within two days of the incident. Following the case evaluation, a member of the team will contact you to further explore your position and offer advice tailored to your unique situation.

Evidence Gathering

Evidence is critical in changing the case in your favor, just like it is in any other criminal case; therefore, we’ll start collecting evidence and evaluating brokers right away. Members of the team will trace your steps back to the fraudster, collecting any and all necessary evidence. Calls, messages, e-mail, screenshots, billings, bills, and the whole digital footprint are all part of the package. You’ll be working closely with digital analysts at this point to ensure that all relevant evidence is recovered and your case is as strong as feasible.

Developing Your Argument

Many individuals believe that everything will be alright if the evidence is recovered. That is not the case, however.

From here, team members will begin the paperwork for your case. To ensure that the data is not rejected by the financial institutions concerned, it is arranged in an efficient, effective, and viable manner. This needs a thorough understanding of legal documents, which is exactly why we’re here!

Confront the Authorities

It is critical to address the entities that have harmed you, stolen from you, and perpetrated the scam in order to restore control of your finances and precious assets. It is done, however, in a systematic manner in which they are faced with their illegal activities with supporting materials so that they cannot deny what they have done.

Get Your Money Back

This is the last phase in the rehabilitation process. The recovery specialists design a specific method for resolving the matter at this point; they consider going straight to the fraudster or enlisting the assistance of third parties.

They start by confronting the fraudster directly, explaining the facts, and warning them about the repercussions. They are frequently required to reimburse the money. However, if that fails, the team has a backup plan in place, which includes financial institutions. We’ve partnered with payment providers like Transferwise, Paypal, and others to help us recover your funds! They are successful in recovering your payments since they have worked in this industry for a long time, and this isn’t the first time we’ve dealt with a crooked firm.

You have to realize that when it comes to cash recovery professionals, they can do a lot for you that no one else can. While some people start their investigation by looking for scammers, the chances are that we’ve already run into them. As a result, we’re doing good work toward achieving your anticipated outcomes. They quickly know who is to blame when you tell us the name of the broker who scammed you. This allows us to get out to the right people and request that they restore your payments. When you speak with the cops in your neighborhood, however, you will be bombarded with inquiries since the officers are unclear about where to begin.

You don’t want to be in that situation when you’re already frustrated. A lack of power is one of the problems prohibiting customers and dealers like you from pursuing these matters on your own. You are just another person to these internet con artists. When you contact them and ask for your money back, they rarely take you seriously. After a few calls, they’ll take your phone number and never call you again. They’re busy deceiving someone else while you’re attempting to contact them. In this case, though, They may completely turn the tables. If you have a competent fund recovery company, call these fraudsters and inform them how they might be discovered, you can be confident that they will answer and cooperate.

CHAPTER 6: How Effective Are Asset Recovery Firms?

Scam victims, like patients, require assistance, which is provided by fund recovery companies, often known as asset recovery firms.

These are third-party organizations that recruit victims who have been the victims of continuous fraud. These include financial scams, online dating scams, cryptocurrency scams, and a variety of other forms of scams that exist in today’s world. Asset recovery firms then file complaints and cases with the appropriate regulatory agencies with the aim of recovering the stolen funds for the victims in exchange for a fee.

According to recent surveys, approximately 87 percent of persons who registered their case with fund recovery businesses were able to restore access to the majority of their stolen assets, money, and information. If that hadn’t been the case, they could have lost $0.99 billion, if not more. They also supply individuals with information and facts about existing frauds, ensuring that they are safeguarded from future scams. They create cases, send out alerts, and much more. “Not all superheroes adorn capes,” as the saying goes, and this could be true in the case of recovery firms. Individuals can employ a variety of preventative techniques to guarantee that they are safe from all forms of scams in 2022.

If you believe that you are a victim of an internet scam, for example, consult our reference materials to learn how to avoid falling victim to one. Utilize your knowledge to your advantage. People have reported that once they became aware of certain scams and how they are carried out, they were able to save themselves more frequently, lowering the scam risk rate by 77.46 percent.

Individuals are also turning to third-party solutions to protect their accounts, online data in the cloud, usernames, and passwords. This protects them from a variety of scams, including banking and online fraud. Many apps, such as Apple Passcode Keychain and other dependable technical applications, work as vaults to keep your data safe. If you want to find out how to protect your financial assets in 2022, or if you’re a victim of fraud, contact our consultants to put you in touch with the best recovery firm in town!

Chargebacking is pleased to inform you that in the last seven years, it has successfully recovered $97,000+ by winning 120+ cases. Industry specialists, experienced analysts, and cyber detectives make up the Chargebacking team, and they’re here to help you combat the growing surge in online scams of all kinds. Chargebacking’s main goal is to help their clients get their money back – whether it’s a crypto scam, a dating scam, or a forex scam, they’ll go to any length to win their case.

CHAPTER 7: Consider These Factors Before Hiring a Third-Party Funds Recovery Firm

Fees – What will the cost of the service be? Some organizations charge a one-time fee ranging from $2,500 to $10,000, while others charge on a sliding basis based on the magnitude of the initial investment.

- What data will you collect as a result of your investigation? Typically, pledges to acquire data merely entail compiling data from publicly available sources.

- What does it mean to offer legal assistance? These companies often lack the legal expertise to counsel you on all of your legal options or to file a class-action lawsuit on your behalf. Beyond a demand letter, most people are unable to reach an agreement.

- Coordination with state, federal, and provincial authorities — In reality, these firms file boilerplate investor complaints that are devoid of information that a regulator would find useful.

CHAPTER 8: Be Aware of Your Legal Rights!

Victims of crime and scams have rights under federal and, in some situations, state law. To better protect yourself, learn about your rights. The United States Justice Department, also known as (DOJ), provides information on victim rights and financial fraud at the federal level.

In addition, the Department of Justice’s Office for Victims of Crime (OVC) has a document called What You May Do If You Are a Victim of Crime that explains crime victim rights and where you can seek help. On a state level, contact your Attorney General, whose contact information can be found at www.naag.org. A helpful “Investor Bill of Rights” is published by the North American Securities Administrators Association.

It’s Never Too Late To Start Recovering Your Funds From an Investment Scam

Scams are all over the Internet, which is a sad fact. It’s becoming increasingly difficult to tell whether you’re getting accurate information or being fed bogus news. Whether it’s forex and crypto scams, romance scams, or credit card theft, it’s evident that unscrupulous people are after our personal information and money.

Thousands of adverts bombard the typical individual every day, many of which are fake. As modern technology becomes more available to the general public, people who wish to perpetrate fraud from the ease of their own homes will be able to pass themselves off as credible brokers or investing gurus. Scammers now have more victims to prey on, thanks to social media.

It is of utmost importance that you do not fall prey to these con artists. Regardless, our goal is to provide you with magnitudes of free information so that you can regain access to your assets. Despite the fact that complete success is rare, financial recovery organizations refund millions of dollars to customers every year. Fraud is a complex topic, and even many law enforcement officers have difficulty locating con artists. When compared to going it alone, using our services will almost certainly boost your chances of obtaining your money back significantly.

Chargebacking is a funds recovery investigation firm that attempts to provide you with the top consultants in the fund recovery industry to help you recover your money from scammers. Did you know that various forms of fraud have caused the economy to lose $2.1 billion? Chargebacking cannot stand by and watch as scammers wreak havoc on our economy! Chargebacking is well aware that millions of people have been duped out of enormous quantities of money, and they are ready to fight alongside you to reclaim your funds and restore the economy.

Experts in charge backing convene to study, analyze, and investigate details in order to track down and catch the corporation that cheated you and recover the money you lost. No matter how complicated the case is, chargebacking will help you recover your assets.

- Do not transfer any more money to the company if you suspect you’ve been misled.

- Inform your bank or other financial institution.

- Be wary of follow-up scams or pledges to assist you in recovering your funds.

- Contact ASIC or your local police department to report it.

If you’ve been a victim of internet fraud, don’t panic. You can work with our team of experts to find the best asset recovery firm for yourself!

do you need help?

A lot of those who contact us have questions and concerns about their personal and business data being compromised. We aim to arm you with the legal and technical know-how in the fight against scams. Also, we will be able to refer you to top scam recovery agencies.

Please fill up the form. Rest assured that our support team will get in touch with you